Is it relevant to me?

This “Cheat Sheet” will be relevant to you if:

- Your entity is a for-profit entity

- Your entity currently recognises revenue over-time on a percentage-of-completion (PoC) basis, and/or

- Your entity operates in the construction, logistics, professional services, customised products industries, or any other entity that applies over-time, PoC accounting.

What might the cheat sheet reveal?

This “Cheat Sheet” might reveal that:

- Your entity may not meet the new criteria that requires revenue to be recognised over-time, or

- Your entity may now be required to recognise revenue over-time, and/or

- Your overall accounting for contracts recognised on an over-time basis may change, as a consequence of the PoC basis no longer available with respect to (construction/input) costs.

Your entity may need to engage legal experts to determine whether particular aspects of the new over-time criteria are met (or not).

Also, if the numbers in the financial statements are required to change, management will need to consider the consequential impacts to areas such as bank covenants, staff bonuses, and earn-out clauses etc.

Need Assistance with assessing the impact?

BDO IFRS Advisory is a dedicated service line available to assist entities in transitioning to new accounting standards. Further details are provided on the following pages for your information.

Background

A number of for-profit entities in New Zealand will be busy considering the impacts of the new revenue recognition standard (NZ IFRS 15) for their current reporting periods[1].

While this should absolutely be a focus for all for-profit Tier 1 and 2 general purpose reporting entities currently preparing financial statements under NZ IFRS and NZ IFRS (RDR) respectively, entities currently preparing financial statements under special purpose accounting frameworks (SPFR) still need to sit up and take notice.

This is because if the application of NZ IFRS 15 would push a current SPFR entity above the “large entity” revenue thresholds[2], then (i) they will be scoped into NZ IFRS (RDR), and (ii) therefore need to be applying NZ IFRS 15, in future financial periods[3].

This will be particularly relevant for entities that recognise revenue over-time at present, but would fail the new criteria imposed by NZ IFRS 15 to do so – i.e. resulting in a more “lumpy”, point in time revenue recognition profile which may consequentially aggregate revenue from specific contracts within a single, specific period.

So what has changed and what do I need to be aware of?

There are two significant changes that we would like to highlight in this Cheat Sheet:

- There is a new over-time revenue recognition criteria that ALL entities must initially assess.

This means that point-in-time revenue recognition applies if, and only if, none of the over-time criteria are met).

Also, it is key to note that over-time recognition under NZ IFRS 15 may not necessarily result in the same revenue recognition profile as the PoC basis currently.

- PoC accounting, as it is currently applied with respect to (construction/input) costs, is no longer available.

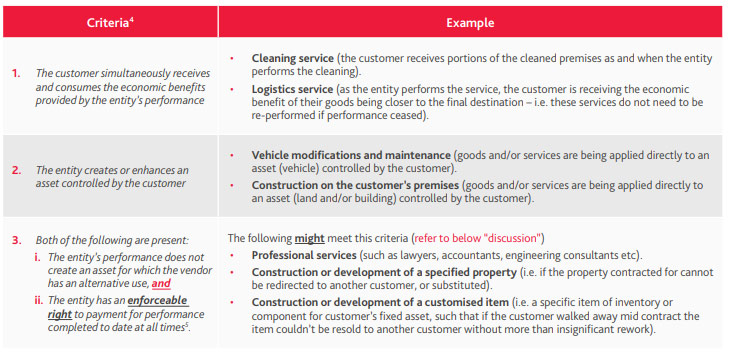

A. New over-time revenue recognition criteria

The new criteria has been introduced to make the distinction between over-time and point-in-time revenue recognition a binary and mutually exclusive determination (i.e. if it is not one, it is the other).

If an entity satisfies any of the three new over-time criteria, revenue MUST be recognised over-time – it is not a choice.

Previously, the distinction was open to interpretation and judgement resulting in different revenue recognition practices for the same transactions of different entities – for example, there has been up until now inconsistent revenue recognition application from entities operating in the logistics industry (i.e. revenue recognised proportionally over-time as the delivery is provided over days/months, or only at a point-in-time upon delivery when the customer receives the completed service). The new over-time requirements of NZ IFRS 15 have now resolved these inconsistencies.

Discussion on the third over-time criteria above

The analysis of the third over-time criteria has proved to be the most problematic and “involved” in applying NZ IFRS 15.

Ordinarily, the first “prong” (i) looking at alternative use is fairly easy to determine:

- For professional services, it may be contractually prohibited and/or practically impossible to utilise the result of the service provided for an alternate customer, if the current customer were to “walk away” mid contract (i.e. a specific report etc.).

- For construction or development of a specified property (i.e. land title plot, apartment number etc.) ordinarily the specified property, and only the specified property, must be delivered to the customer in all instances – i.e. the entity cannot substitute in an alternative property to satisfy the contract with the customer.

- For construction or development of a customised item (i.e. component to be fixed to an entities asset, specialised inventory etc.) it may be contractually prohibited and/or practically impossible to utilise the item produced for an alternate customer (without more than insignificant rework) if the current customer were to “walk away” mid contract.

However, it is the second “prong” (ii) looking at enforceable rights to payment where things can come undone. This is because:

- “Payment for performance completed to date” is referring to payment in the amount of revenue that has been recognised for accounting, and NOT any form of contractual progress or milestone (cash) payments, and

- “Enforceability” is referring to LEGAL enforceability.

As such, irrespective of what the contract says around recourse and repayment over the term of the contract if the customer were to “walk away” mid contract, would the courts in the jurisdiction where recourse would be sought uphold (i.e. enforce) this.

This is a question of law rather than accounting, and therefore almost always requires the advice of legal experts, both in the entity’s country of incorporation AND any separate jurisdictions that an entity operates and/or sells within.

It may be that in some case, for certain contracts, that the courts instead require an entity to mitigate their losses by finding an alternate purchaser for the item, and then subsequently, only being able to recover any actual incurred losses from the original customer (i.e. particularly common in contracts relating to property). In such a scenario (i.e. recovery only of losses/costs) the “Enforceability” requirement is not met under NZ IFRS 15.

B. Removal of percentage-of-completion (PoC) accounting with respect to costs.

The objective of the previous construction contract accounting standard (NZ IAS 11), which in practice was applied more broadly than to just contracts related to the construction of property, was to achieve a “smoothing” of gross margin over the contract term.

This was achieved by NZ IAS 11 requiring the PoC approach to be applied not only to revenue, but also to (construction/input) costs.

This application to (construction/input) costs is not addressed in NZ IFRS 15, nor any other accounting standard.

This now means that construction costs are recognised on an as-incurred basis, in line with general accrual accounting principles.

When these costs relate to physical goods that are yet to be deployed to satisfying a customer’s contract, these would be recognised as the entity’s inventory (work-in-progress) until deployed (as the entity maintains control over such items until control is transferred to the customer upon deployment).

However in other cases (i.e. costs related to services being provided) these are recognised as cost of sales as they are incurred (and not a “WIP” asset held in the balance sheet), against the revenue that has been recognised for accounting purposes.

Depending on what basis (i.e. input or output) the entity is recognising its revenue on, this will likely result in varying margins over the contractual period.

This will be almost always the case where an output-method is used (i.e. appraisals of results, milestones reached, units produced and units delivered etc.). This is because the cumulative (or periodic) outputs driving the amount of revenue to recognise may not be commensurate with the cumulative (or periodic) costs incurred.

As a result, in some cases, losses may be experienced in some periods, particularly in the early stages of the contract, even though the contract is anticipated to be profitable overall.

This is a substantial change from how entities have previously been required to account for these contracts, and may require significant “unpicking” of the accounting applied in both the current (transition) year, and comparative periods presented.

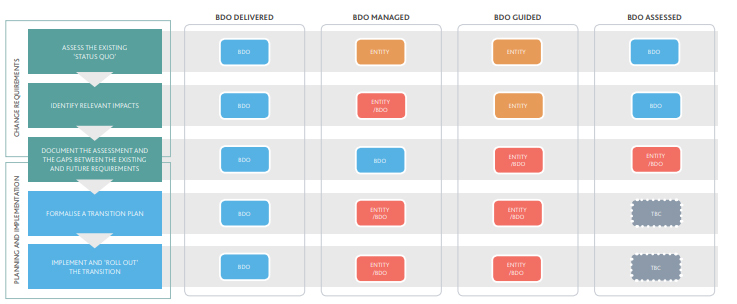

BDO IFRS Advisory – Tailored Transition Assistance

BDO’s adopts a flexible approach to assisting entities with their transition to new accounting standards including NZ IFRS 15, meaning we can be as involved as an entity requires, based on their own in-house resourcing and expertise at their disposal.

Often entities don’t know exactly where to start or focus their energies, and just want to get the ball rolling.

We have found our BDO Guided and BDO Assessed approaches fit well to accommodate this, whilst also retaining the ability to scale up involvement quickly if need be – either way, we work WITH you.

For more information as to how BDO IFRS Advisory might assist with assessing the impact of your transition to NZ IFRS and any other new accounting standards please contact James Lindsay or visit our IFRS Advisory homepage.

[1] Being year ends 31 December 2018 and beyond (i.e. 31 March 2019, 30 June 2019 etc.

[2] NZ companies: $60m assets, or $30m revenue, Foreign owned companies: $20m assets, or $10m revenue; in the preceding two years.

[3] For the financial year immediately following two consecutive years of breaching the “large entity” thresholds.

[4] Refer NZ IFRS 15 para 35(a), (b), (c)).

[5] This must include an element of margin. Merely having a right to recover costs is not sufficient to meet NZ IFRS 15’s “enforceable right to payment” requirement.