Entities will be aware that on 24 May 2021 the Holidays (Increasing Sick Leave) Amendment Bill (the “Bill”) gained royal assent and came into effect as an act in New Zealand. The Bill will increase the minimum amount of paid sick leave entitlements to which an employee is entitled from five days per annum to 10 days per annum, from 24 July 2021.

More specific details regarding the nuts-and-bolts of the Bill can be found in BDO’s Insights article.

Aside from the practicable changes that the Bill will introduce, there are accounting considerations that for-profit entities that report under NZ IFRS or NZ IFRS (RDR) will need to consider, namely:

- The number of sick leave days owing to employees within an entity’s Employee benefit liability balance may change, and

- Whether sick leave accruals that previously met the definition of a Short-term employee benefit will continue to do so, thereby continuing to be:

(i) Measured on an undiscounted basis, and

(ii) Presented, in full, as a “current liability”.

With respect to (1), depending on the type of employee sick leave entitlements an entity has, the Bill might actually result in a decrease in the amount required to be accrued.

With respect to (2), consideration of whether employee benefit accruals meet the definition of a short-term employee benefit is not a “new” consideration for NZ IFRS and NZ IFRS (RDR) reporting entities, and should be considered “business as usual”.

All entities need to be aware of how and why consideration of whether their employee sick leave entitlements meet the definition of a short-term employee benefit. However, situations where this becomes a material, practicable consideration are typically where entities have:

- A large employee base;

- A large sick leave entitlement balance; and/or

- A history of employees not utilising their sick leave entitlements in full each year, and subsequently (i.e., the sick leave accrual is growing year-on-year).

This Cheat Sheet will highlight the potential impacts that the Bill may have on the accounting treatment of employee sick leave entitlements for NZ IGFS and NZ IFRS (RDR) reporters.

Also, as discussed in the sections below, this Cheat Sheet is equally applicable to Tier 1 and Tier 2 Public Benefit entities, as the definition of short-term employee benefit is the same under the PBE IPSAS and PBE IPSAS (RDR) financial reporting frameworks that these entities use.

Need assistance with NZ IFRS or NZ IFRS (RDR)?

BDO Financial Reporting Advisory is a dedicated service line available to assist entities in adopting and applying NZ IFRS or NZ IFRS (RDR). Further details are provided on the following page for your information.

What is covered in this Cheat Sheet

In order to navigate through these areas of accounting, this Cheat Sheet is broken down into the following sections:

Reminder: When the definition of short-term employee benefit in NZ IAS 19 changed

Back in 2013, a subtle but consequential amendment to the definition of a short-term employee benefit in NZ IAS 19 Employee Benefits became effective.

Prior to 2013, if an employee was entitled to the benefit in the 12 months following reporting date, then the entire benefit met the definition of a short-term employee benefit. In practice, because employees are not usually restricted in terms of when they are able take their leave entitlements (and/or may have them “paid out” if they cease to be employed) the definition was able to be clearly met.

Then the amendment to NZ IAS 19 occurred in 2013, the focus in the definition of short-term employee benefit shifted to where benefits were expected to be WHOLLY settled 12 months from reporting date. This required entities to utilise more judgement in terms of when they believed (based on historical experience, and the future outlook) these balances would actually be utilised, rather than when they (legally) could be utilised.

Accordingly, this change from “could” to “would” resulted in the timing of the use of employee sick leave entitlements, for certain employees, being pushed beyond 12 months from reporting date.

Accordingly, this Cheat Sheet is equally applicable to these entities.

Consequences of sick leave entitlements not meeting the definition of a short-term employee benefit

NZ IAS 19 defines and provides the accounting treatments of various employee benefit liabilities, that include:

- Short-term employee benefits.

- Post-employment benefits (such as Defined Benefit Plans, Defined Contribution Plans, Retirement benefits etc.).

- Termination benefits.

Employee benefits that don’t “fit” into the definition of the above default into being classified as other long-term employee benefits.

Accordingly, where employee entitlements fail the short-term employee benefit definition (i.e., where any part of the entitlement is expected to be settled

later than 12 months from reporting date), they are (in their entirety) classified and measured as other long-term employee benefits.

Other long-term employee benefits are accounted for using the projected unit credit method (an actuarial valuation, that is similarly required for Defined

Benefit Plans).

Remeasurements of other long-term employee benefits are recognised immediately through profit or loss.

How to determine if, and to what extent, sick leave entitlements fail the definition of a short-term employee benefit

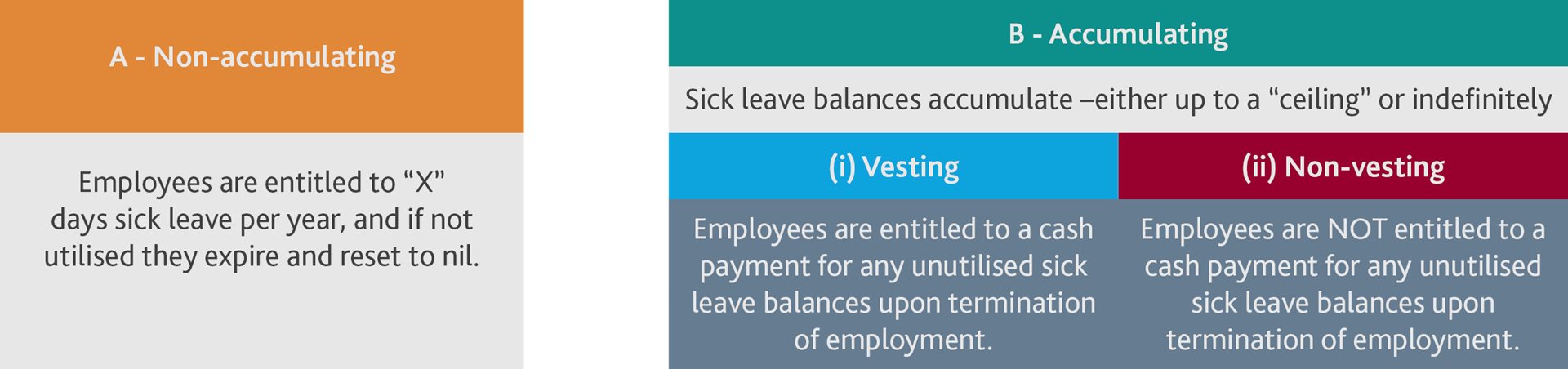

In order to make this determination, it is important to understand the different types (classifications) of sick leave entitlements that exist:

The vast majority of New Zealand entities have Accumulated and non-vesting sick leave entitlements (B(ii)).

However, for entities where this is not the case, and/or entities with operations in other overseas jurisdictions, the specific classification will need to be

assessed and determined.

How each of these classifications is accounted for under NZ IAS 19 is detailed below:

A – Non-accumulating

For each employee, determine (based on past experience and other judgements and estimates) how many days of the sick leave accrued as at period end

would be used before those days expire, and accrue only for those days.

The accrual will meet the definition of a short-term employee benefit.

B(i) – Accumulating and vesting

For each employee, accrue the entire amount, as well as estimate as to WHEN the leave would be likely to be settled (based on past experience and other

judgements and estimates), being either:

(i) Through being taken as sick leave, or

(ii) Paid out upon termination of employment (if applicable in the relevant jurisdiction).

If there is any sick leave, for any single employee, where the “WHEN” is greater than 12 months after reporting date, then the entire sick leave accrual

in aggregate, for all employees, fails the definition of a short-term employee benefit (i.e. as the balance is not expected to be WHOLLY settled within 12

months of reporting date).

Instead, the entire sick leave entitlement balance of the entity is classified, and measured, as an other long-term liability (refer to section 2. above).

This may require the entity to engage actuarial specialists in order to correctly model the sick leave entitlement obligation.

B(ii) – Accumulating and non-vesting

In this situation, the employee only benefits from sick leave entitlements if they actually make use of it whilst they are employed (i.e., accrued balances are

not paid out if they cease employment).

Further, because sick leave entitlements get (automatically) topped-up at each employee’s annual anniversary date, an entity only needs to accrue, for

each employee, the number of sick days expected to be taken over-and-above their annual sick leave entitlement, provided they have sufficient historical

accrued sick leave at reporting date.

Consider the below examples for an illustration of this point.

| Scenario A | Scenario B | Scenario C | Scenario D | |

| Annual entitlement | 10 days | 10 days | 10 days | 10 days |

| Accrued sick leave days at year end |

18 days | 1 day | 18 days | - |

| Expected sick leave to be taken in the 12 months after year end |

11 days | 11 days | 9 days | 11 days |

| Days of sick leave to accrue |

1 day (i.e., the excess of the 11 days of expected leave, less, 10 days of annual entitlement to be earned in the next year, to which the employee has a sufficient accrued sick leave entitlement balance of 18 days) |

1 day (i.e., the excess of the 11 days of expected leave, less, 10 days of annual entitlement to be earned in the next year, to which the employee has a sufficient accrued sick leave entitlement balance of 1 day) |

- (i.e., as the employee’s 10-day annual entitlement to be earned in the next year will sufficiently cover the 9 days of expected sick leave to be taken, no sick leave need be accrued) |

- (i.e., at reporting date, the employee does not have an accrued sick leave entitlement to cover the excess in expected leave to be taken – presumably, this would need to be taken as unpaid leave) |

Here, you can see that when you are dealing with accumulating and non-vesting sick leave, the key factors to consider are not necessarily how many sick leave entitlement days an employee actually has contractually accrued, but rather what their expected sick leave usage is in the next 12 months over-and-above the next annual entitlement top-up that the employee will receive.

The accrual will meet the definition of a short-term employee benefit.

Final thoughts and your go-forward requirements

It is not expected that entities based in New Zealand would have material sick leave accrual balances, due to the fact that the vast majority of New Zealand entities have Accumulating non-vesting sick leave entitlements.

However, entities with operations in other overseas jurisdictions need to consider whether the type of sick leave in those jurisdictions requires separate consideration.

Another (perhaps counter-intuitive) consequence is that entities that have Accumulating non-vesting sick leave entitlements and are stepping up from five days to 10 days, may actually see the value of their sick leave accrual amounts decrease.

Considering the examples above, when the new 10 day entitlements kick-in (noting the timing of this will be different for different employees – refer to the BDO’s Insights article (click here)) it will only be employees that: (i) are expected to take sick leave in excess of 10 days; and, (ii) that already have accrued sick leave entitlement balances in excess of 10 days; where sick leave accruals will continue to accounted for.

For entities previously applying the five-day minimum, scenarios (i) and/or (ii) may be few and far between in the immediate future, consider the below example, where the only difference is an increase in the annual entitlement as a result of the Bill.

| Scenario E(i) | Scenario E(i) | |

| Annual entitlement | 5 days (old) | 10 days (new) |

| Accrued sick leave days at year end |

7 days | 7 days |

| Expected sick leave to be taken in the 12 months after year end |

6 days | 6 days |

| Days of sick leave to accrue |

1 day (i.e., excess of the 6 days of expected leave, less, 5 days of annual entitlement to be earned in the next year, to which the employee has a sufficient accrued sick leave entitlement balance of 7 days) |

- (i.e., as the employee’s 10-day annual entitlement to be earned in the next year will sufficiently cover the 6 days of expected sick leave to be taken, no sick leave need be accrued) |

Here, the number of sick days to accrue has fallen from one, to nil, solely due to the change in the annual leave entitlement.

However, in practice, entities may have to consider and factor in that the mere presence of a higher sick leave entitlement may in and of itself result in a greater level of sick leave being taken compared to historical trends – a “use it or lose it” mentality.

In any case, reasonable and supportable estimates and judgements will be required to be made by entities when considering the accounting treatment of sick leave entitlements in light of the statutory increase from five days to 10 days.

BDO Financial Reporting Advisory

Members of BDO’s Financial Reporting Advisory department come ready with real life experience in applying IFRS and are therefore well placed to provide entities with the expertise and assistance they require.

For more information as to how BDO Financial Reporting Advisory Services might assist with your entity in navigating this and other areas of IFRS application, please contact James Lindsay at BDO Financial Reporting (james.lindsay@bdo.co.nz, ph +64 9 366 8041).

For more information as to how BDO Financial Reporting Advisory Services might assist with your entity in navigating this and other areas of IFRS application, please contact James Lindsay at BDO Financial Reporting (james.lindsay@bdo.co.nz, ph +64 9 366 8041).

For those entities still working through their adoption of the new lease accounting standard (NZ IFRS 16), visit our dedicated Adopting NZ IFRS 16 webpage for more information and resources on NZ IFRS 16.

This publication has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. The publication cannot be relied upon to cover specific situations and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact your respective BDO member firm to discuss these matters in the context of your particular circumstances.