Going concern – what disclosure is required in financial statements?

The COVID-19 pandemic has resulted in a stressed economic environment on an unprecedented scale in recent history. Pervasive lockdowns have substantially affected overall economic activity, resulting in many businesses experiencing reduced revenues and profitability, and liquidity squeezes, which may raise questions about their ability to continue as a going concern. Given the current environment, a greater degree of judgement than usual may be required to determine whether it is appropriate to prepare financial statements on a going concern basis.

While IAS 1 Presentation of Financial Statements includes some requirements regarding disclosure about going concern, they are not very explicit and can lead to disclosure about going concern uncertainties being somewhat abbreviated or lacking. However, IAS 1 also contains overarching requirements that would require additional information regarding an entity’s ability to continue as a going concern in some circumstances.To support the consistent application of IAS 1 with respect to going concern disclosure, the IFRS Foundation has published educational materials which are summarised in BDO’s recent International Financial Reporting Bulletin, IFRB 2021/03 Going concern – IFRS Foundation publishes guidance on disclosures.

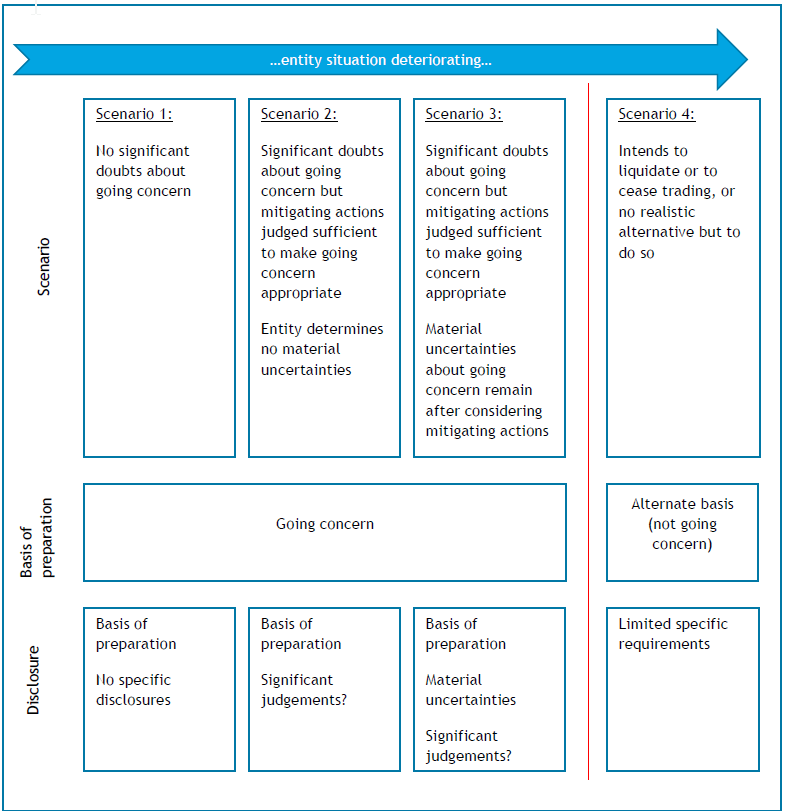

IFRB 2021/03 summarises the disclosure requirements in the following scenarios:

In addition, in New Zealand, the New Zealand Accounting Standards Board issued amendments to FRS-44 New Zealand Additional Disclosures to require additional disclosures when a material uncertainty around going concern exists, as was discussed in our August 2020 edition of Accounting Alert.

For more on the above, please contact your local BDO representative.

This publication has been carefully prepared, but is general commentary only. This publication is not legal or financial advice and should not be relied upon as such. The information in this publication is subject to change at any time and therefore we give no assurance or warranty that the information is current when read. The publication cannot be relied upon to cover any specific situation and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact the BDO member firms in New Zealand to discuss these matters in the context of your particular circumstances.

BDO New Zealand and each BDO member firm in New Zealand, their partners and/or directors, employees and agents do not give any warranty as to the accuracy, reliability or completeness of information contained in this article nor do they accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it, except in so far as any liability under statute cannot be excluded. Read full Disclaimer.