Accounting for a significant financing component in a contract with a customer

In this article, we look at some more examples of step three of the IFRS 15 five step model for revenue recognition introduced by IFRS 15 Revenue from Contracts with Customers:| Step 1 | Identify the contract(s) with the customer |

| Step 2 | Identify the performance obligations in the contract |

| Step 3 | Determine the transaction price |

| Step 4 | Allocate the transaction price to the performance obligations |

| Step 5 | Recognise revenue when a performance obligation is satisfied |

Determining the transaction price in a contract with a customer

The transaction price is defined in IFRS 15 as the “amount of consideration to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer, excluding amounts collected on behalf of third parties”.

The consideration promised in a contract with a customer may include fixed amounts, variable amounts, or both. When determining the transaction price, the entity needs to consider the effects of:

- Variable consideration

- The existence of a significant financing component in the contract

- Non-cash consideration

- Consideration payable to a customer.

A significant financing component in the contract

If the timing of payments agreed to by the parties to the contract (either explicitly or implicitly) provides the customer orthe entity with a significant benefit of financing the transfer of goods or services to the customer, or the entity will need to adjust the promised amount of consideration for the effects of the time value of money when determining the transaction price.

The table below outlines the impact of a significant financing component:

| If the payment is… | That in effect means… | Which results in… |

|---|---|---|

| In arrears | The vendor is providing finance to its customer | Finance income and a reduction in revenue |

| In advance | The vendor is borrowing funds from its customer | Finance expense and increased revenue |

In determining whether a contract contains a financing component, and whether that financing component is significant to the contract, the entity must consider all relevant facts and circumstances, including both of the following:

- The difference, if any, between the amount of promised consideration and the cash selling price of the promised goods or services

- The combined effect of the expected length of time between when the entity transfers the promised goods or services to the customer and when the customer pays for those goods or services and the prevailing interest rates in the relevant market.

Practical expendient - no need to adjust for financing component

As a practical expedient, an entity does not need to adjust the promised amount of consideration for the effects of a significant financing component if the entity expects, at contract inception, that the period between when the entity transfers a promised good or service to a customer and when the customer pays for that good or service will be one year or less.

No financing component

In addition, a contract with a customer will not have a significant financing component if any of the following apply:

- The customer paid for the goods or services in advance and the timing of the transfer of those goods or services is at the discretion of the customer

- A substantial amount of the consideration promised by the customer is variable and the amount or timing of that consideration varies on the basis of the occurrence or non-occurrence of a future event that is not substantially within the control of the customer or the entity (for example, if the consideration is a sales-based royalty)

- The difference between the promised consideration and the cash selling price of the good or service arises for reasons other than the provision of finance to either the customer or the entity, and the difference between those amounts is proportional to the reason for the difference (for example, the payment terms might provide the entity or the customer with protection from the other party failing to adequately complete some or all of its obligations under the contract).

Some example in practice where there would be no financing component include:

- Retentions on construction projects to ensure the customer is protected against the contractor not completing the project to a certain standard

- Two or three-year extented service/warrenty contracts for white goods or motor vehicles paid up front in order to save the entity from incurring monthly administration/collection costs.

What discount rate to use?

When adjusting the promised amount of consideration for a significant financing component, the entity must use the discount rate that would be reflected in a separate financing transaction between the entity and its customer at contract inception.

The discount rate would reflect both of the following:

- The credit characteristics (risk) of the party receiving financing in the contract

- Any collateral or security provided by the customer or the entity, including assets transferred in the contract.

The cash selling price for the goods or services is the price that the customer would pay in cash for the goods or services when (or as) they were transferred to the customer.

Is the discount rate updated?

After contract inception, the entity must not update the discount rate for changes in interest rates or other circumstances (such as a change in the assessment of the customer’s credit risk).

How is the financing component presented in the financial statements?

The effects of financing (interest revenue or interest expense) must be presented separately from revenue from contracts with customers in the statement of comprehensive income.

Example 1 (Based on IFRS 15, Illustrative Example 29) - Receipts in advance

The following example, taken from Illustrative Example 29 that accompanies IFRS 15, illustrates how a significant financing component in a contract with a customer is accounted for under IFRS 15 where the entity recevies payment in advance of the transfer of goods or services to the customer.

Fact pattern

- Company A enters into a contract with a customer to build and supply a new machine.

- Control over the completed machine will pass to the customer in two years (which is the point in time at which Company A’s performance obligation will be satisfied).

- The contract contains two payment options - the customer can pay:

- $5 million in two years (when it obtains control of the machine); or

- $4 million at inception of the contract.

- The customer decides to take the option of paying $4 million at inception.

Analysis

Company A concludes that, because of the significant period of time between the date of payment by the customer and the transfer of the machine to the customer, together with the effect of prevailing market rates of interest, there is a financing component which is significant to the contract.

The interest rate implicit in the transaction is 11.8% (which is the interest rate necessary to make the two alternative payment options economically equivalent). However, because Company A is effectively borrowing from its customer, Company A is also required to consider its own incremental borrowing rate, which is determined to be 6%.

Journal Entries

At inception of the contract, Company A processes the following journal entry to recognise a contract liability:

| Dr ($) |

Cr ($) |

|

| Cash | 4,000,000 | |

| Contract liability | 4,000,000 |

During the two years from contract inception until the transfer of the asset, Company A must adjust the promised amount of consideration, and increase the contract liability by recognising interest on $4,000,000 at 6% per year for two years.

Interest in Year 1 will be $240,000 ($4,000,000 x 6%) and interest in Year 2 will be $254,400 ([$4,000,000 + $240,000] x 6%). The journal entry for the two years combined will be:

| Dr ($) |

Cr ($) |

|

| Interest expense | 494,400 | |

| Contract liability | 494,400 | |

| Being interest for Year 1 of $240,000 plus interest for Year 2 of $254,400 | ||

At the date of transfer of the machine to the customer, Company A then processes the following journal entry:

| Dr ($) |

Cr ($) |

|

| Contract liability | 4,494,400 | |

| Revenue | 4,494,400 | |

| $4,000,000 at inception plus $494,400 interest accreted | ||

Example 2 - Deferred consideration

Following on from Example 1 above, the following example illustrates how a significant financing component in a contract with a customer is accounted for under IFRS 15 where the entity receives consideration after it has transferred goods or services to the customer.

Fact pattern

- On 1 May 2018, Company B enters into a contract with a customer to sell Property A

- Control over Property A passes to the customer on 1 July 2018 when the keys are handed over

- The selling price is $4,494,400, payable on 30 June 2020

- Had the customer paid for the building on 1 July 2018, the consideration would have been $4 million

- The rate that discounts the deferred consideration of $4,494,400 to the cash price of $4 million is 6%, which reflects the credit characteristics of the customer.

Analysis

Company B concludes that the contract contains a significant financing component because the selling price (deferred consideration) of $4,494,400 includes a 6% interest charge to the customer for two years’ financing.

Company B therefore recognises only $4 million as revenue and the remaining $494,400 consideration as interest income.

Journal entries

At inception of the contract, Company B processes the following journal entry to recognise revenue:

| Dr ($) |

Cr ($) |

|

| Receivable | 4,000,000 | |

| Revenue | 4,000,000 |

Company B then accretes 6% interest income to the receivable during the period from 1 July 2018 (the date Property A is transferred to the customer) to 30 June 2020 (the date when payment of the total consideration of $4,494,400 is made).

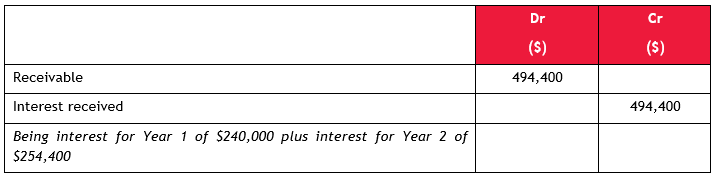

Interest in Year 1 will be $240,000 ($4,000,000 x 6%) and interest in Year 2 will be $254,400 ([$4,000,000 + $240,000] x 6%). The journal entry for the two years combined will be:

|

Dr |

Cr |

|

| Receivable | 494,400 | |

| Interest received | 494,400 | |

| Being interest for Year 1 of $240,000 plus interest for Year 2 of $254,400 | ||

Concluding thoughts

Concluding thoughts

When revenue is earned it would be unusual for there to be a substantial time difference between delivery of the goods or services and payment for those goods or services. Where a substantial time difference does exist, we need to consider whether there is a significant financing component in the transaction price, or whether the time delay occured for a reason other than a significant financing component in the contract (e.g. the customer having paid for the goods or services in advance and the timing of the transfer of those goods or services being at the discretion of the customer). Finance teams will need to ensure that they fully understand the terms and conditions of contracts with their customers, so that they can identify the existence of a significant financing component and ensure that it is accounted for correctly.

For more on the above, please contact your local BDO representative.