Classification and Measurement of Financial Assets Under PBE IPSAS 41

In the February 2021 edition of Accounting Alert we noted that public benefit entities face substantial changes to accounting for financial instruments, due to PBE IPSAS 41 Financial Instruments (“PBE IPSAS 41”) replacing PBE IPSAS 29 Financial Instruments: Recognition and Measurement (“PBE IPSAS 29”) for financial reporting periods beginning on or after 1 January 2022.

One of the key differences introduced by PBE IPSAS 41 relates to the manner in which financial assets are classified and measured. The difference relates not just to the measurement options available, but also to the process that is followed when determining the measurement basis that will apply, with PBE IPSAS 41 being more prescriptive than PBE IPSAS 29.

Under PBE IPSAS 29, financial asset classification, and consequently measurement, is based on the financial asset’s characteristics and management’s intention in relation to the asset. For example:

| An investment in: | Will be classified as: | And carried at: | If management intends to: |

| The ordinary shares of another entity | A financial asset at fair value through surplus or deficit | Fair value, with value changes recognised in surplus or deficit | Hold the financial asset for trading (short term profit taking) |

| Available for sale | Fair value, with value changes recognised in other comprehensive revenue and expense | Hold the financial asset for the longer term | |

| The debt instruments (such as bonds) of another entity | A financial asset at fair value through surplus or deficit | Fair value, with fair value changes recognised in surplus or deficit | Hold the financial asset for trading (short term profit taking) |

| Held to maturity | Amortised cost (which results in value changes being recognised in surplus or deficit) | Hold the financial asset to maturity and the entity has the ability to do so | |

| Available for sale | Fair value, with value changes recognised in other comprehensive revenue and expense | Hold the financial asset for the longer term, but not until maturity |

When PBE IPSAS 41 is adopted, classification of financial assets will be based on the characteristics of the financial asset and the management model under which the financial asset is held. The management model under which a financial asset is held is determined on the basis of how an entity typically utilises such assets – it is therefore based on practice, rather than on intention.

The other key difference between PBE IPSAS 41 and PBE IPSAS 29 in the classification of financial assets is the default measurement approach. Under PBE IPSAS 41, the default financial asset measurement approach is fair value through surplus or deficit, while under PBE IPSAS 29 is it available for sale (which also requires measurement at fair value, but results in less volatility in surplus or deficit, as fair value changes are recognised in other comprehensive revenue and expense).

Initial measurement of financial assets under PBE IPSAS 41

Under PBE IPSAS 41, as under PBE IPSAS 29, a financial asset is initially measured at fair value plus transaction costs, unless it is carried at fair value through surplus or deficit, in which case transaction costs are expensed. However, under PBE IPSAS 41 there is an exemption to this requirement – trade receivables without a significant financing component are initially recognised at the transaction price.

Under PBE IPSAS 41, the manner in which a financial asset is measured after initial recognition is dependent on whether it is an equity instrument, or a non-equity instrument.

Subsequent measurement where the financial asset is a non-equity instrument

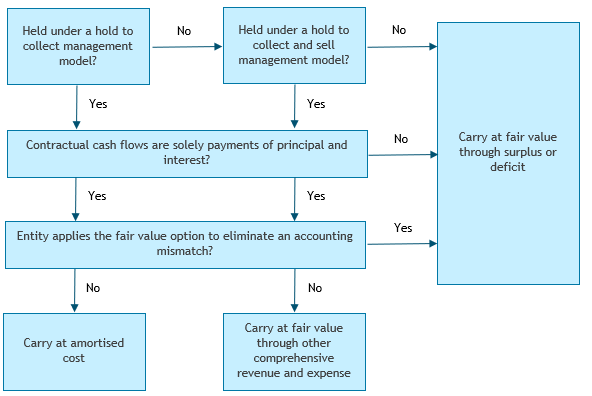

Where a financial asset is a non-equity instrument (for example, a debt instrument), the default measurement approach is fair value through surplus or deficit; measurement at amortised cost or at fair value through other comprehensive revenue and expense only occurs if specified criteria are met:

| If the instrument is: | It may be measured at: | If: |

| A non-equity instrument (for example, a debt instrument) | Amortised cost | It meets both (1) the contractual cash flow characteristics test and (2) the hold to collect management model test |

| Fair value through other comprehensive revenue and expense | It meets both (1) the contractual cash flow characteristics test and (2) the hold to collect and sell management model test |

A financial asset will pass the:

- Contractual cash flow characteristics test if the financial asset gives rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding, with the key components of interest being the time value of money and credit risk

- Hold to collect management model test if it is held within a management model whose objective is to hold financial assets in order to collect contractual cash flows

- Hold to collect and sell management model test if it is held within a management model whose objective is to both collect contractual cash flows and sell the financial asset.

Even if a non-equity financial asset meets the criteria for measurement at amortised cost or at fair value through other comprehensive revenue and expense, the entity can elect to carry it at fair value through surplus or deficit to eliminate an accounting mismatch.

The following flow chart shows how non-equity financial assets are classified under PBE IPSAS 41:

Subsequent measurement where the financial asset is an equity instrument

Where a financial asset is an equity instrument, the default measurement approach is fair value through surplus or deficit; measurement at fair value through other comprehensive revenue and expense only occurs if specified criteria are met:

| If the instrument is: | It may be measured at: | If: |

| An equity instrument | Fair value through other comprehensive revenue and expense | It (1) is not held for trading and (2) an irrevocable election is made at initial acquisition |

The following flow chart shows how financial assets that are equity instruments are classified under PBE IPSAS 41:

Concluding thoughts

Under both PBE IPSAS 41 and PBE IPSAS 29, the characteristics of a financial asset are central to the manner in which it will be measured subsequent to initial recognition. Under PBE IPSAS 29, management’s intentions in relation to a financial asset are also considered when determining the basis of measurement. However, under PBE IPSAS 41, management intention is irrelevant to measurement, and it is instead the entity’s management model in relation to financial assets that must be considered when determining measurement.

Determining the management model under which financial assets are held will require examination of past practice. For those organisations that are audited, it’s likely that your auditor will require more evidence to support your financial asset classification decisions than has been required in the past.

For more information on the above, please contact your local BDO representative.

This publication has been carefully prepared, but is general commentary only. This publication is not legal or financial advice and should not be relied upon as such. The information in this publication is subject to change at any time and therefore we give no assurance or warranty that the information is current when read. The publication cannot be relied upon to cover any specific situation and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact the BDO member firms in New Zealand to discuss these matters in the context of your particular circumstances.

BDO New Zealand and each BDO member firm in New Zealand, their partners and/or directors, employees and agents do not give any warranty as to the accuracy, reliability or completeness of information contained in this article nor do they accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it, except in so far as any liability under statute cannot be excluded. Read full Disclaimer.