IASB extends practical expedient for COVID-19 rent concessions until 30 June 2022

On 31 March 2021, the International Accounting Standards Board (IASB) approved an extension for the use of the practical expedient when accounting for COVID-19-related rent concessions until 30 June 2022 (extended practical expedient). Previously, lessees receiving rent concessions due to COVID-19 could only use the practical expedient if there was a reduction in lease payments due before 30 June 2021 (original practical expedient).

The extension of the practical expedient to 30 June 2022 means that lessees receiving ongoing rent concessions due to extended lockdowns can choose the ‘easier’ option not to treat the reductions in lease payments as lease modifications. However, this choice is only available if lessees had previously applied the original practical expedient to eligible contracts with similar characteristics and in similar circumstances (e.g., to lease contracts for retail stores).Why is a practical expedient needed?

IFRS 16 Leases has complex accounting requirements when lease payments change because of a modification to the original lease agreement, including having to determine a revised discount rate at the date of the modification. It is also sometimes difficult to determine whether a lease has been modified, or whether amended lease payments were anticipated in the original lease agreement. With so many lessees receiving rent concessions, it could be a very time-consuming process to ascertain for each lease:

- Whether there has been a lease modification, and

- If so, what the revised discount rate should be?

How does the extended practical expedient work?

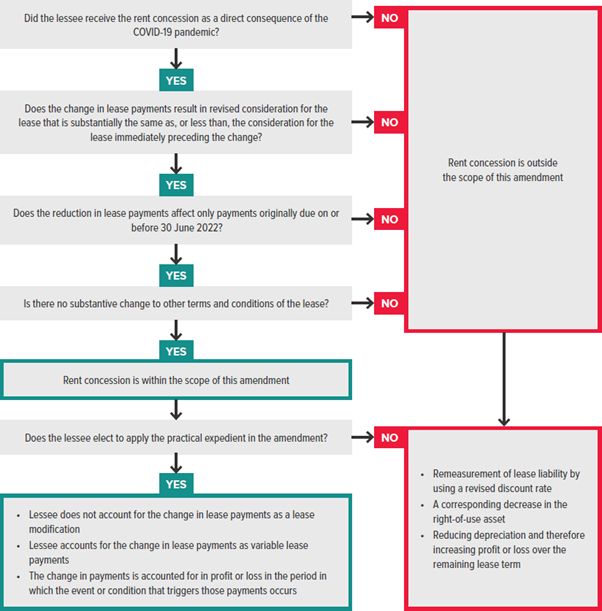

As illustrated in the diagram below, if certain conditions are met (including the reduction in lease payments affecting only lease payments due and payable on or before 30 June 2022), the lessee can choose not to account for the changes as a lease modification, even if it ordinarily would be accounted as a lease modification under IFRS 16.

Example 1 - Lessee previously elected NOT to apply the original practical expedient to eligible rent concessions

Lessee A receives a ‘first wave’ COVID-19-related rent concession for its Retail Store A in Shopping Centre A. The rent concession results in a reduction in lease payments originally due before 30 June 2021.

Lessee A chose not to apply the original practical expedient (even though it is eligible) in its 30 June 2020 financial statements because it only has a few retail store leases and Retail Store A is the only one that received a rent concession. Lessee A therefore accounts for the rent concession relating to Retails Store A as a lease modification because there was no reference to such concession in the original lease agreement.

On 1 January 2021, Lessee A receives a ‘second wave’ COVID-19-related rent concession which results in a reduction in lease payments for Retail Store A that are originally due before 30 June 2022.

Can Lessee A choose to apply the extended practical expedient to the ‘second wave’ rent concession?

No. The transitional provisions for the extended practical expedient require that it be applied consistently to eligible contracts with similar contracts and in similar circumstances (e.g., retail store leases), regardless of whether the rent concession becomes eligible because of the original practical expedient or the extended practical expedient.

Can Lessee A choose to apply the extended practical expedient if the ‘second wave’ rent concession related to a different retail store (e.g., Retail Store B)?

Also no. As noted above, the transitional provisions for the extended practical expedient require that it be applied consistently to eligible contracts with similar contracts and in similar circumstances, regardless of whether the rent concession becomes eligible because of the original practical expedient, or the extended practical expedient.

Example 2 - Lessee previously elected to apply the original practical expedient to eligible rent concessions

Lessee B receives a ‘first wave’ COVID-19-related rent concession for its Retail Store B in Shopping Centre B. The rent concession results in a reduction in lease payments originally due before 30 June 2021.

Lessee B chose to apply the original practical expedient in its 30 June 2020 financial statements to the rent concession received for Retail Store B, and therefore does not account for the concession as a lease modification.

On 1 January 2021, Lessee B receives a ‘second wave’ COVID-19-related rent concession that results in a reduction in lease payments for Retail Store B that are originally due before 30 June 2022.

Can Lessee B choose to apply the extended practical expedient to the ‘second wave’ rent concession for Retail Store B?

Lessee B does not have a choice whether to apply the extended practical expedient, or not. Lessee B MUST apply the extended practical expedient to the rent concession for Retail Store B because the transitional provisions for the extended practical expedient require that it be applied consistently to eligible contracts with similar contracts and in similar circumstances.

Therefore, if Lessee B had applied the original practical expedient to the ‘first wave’ rent concession, it must apply the extended practical expedient to the ‘second wave’ rent concession because it is a further variation to the same lease contract (i.e., similar contract under similar circumstances).

Without the extended practical expedient, the appropriate accounting for the ‘second wave’ rent concession would have been unclear, i.e.:

- Should the original practical expedient accounting be invalidated because the concession now results in a reduction in lease payments past 30 June 2021, and therefore be accounted for as a lease modification; or

- Should the original practical expedient accounting remain and only the ‘second wave’ concession be accounted for as a lease modification?

Can Lessee B choose to apply the extended practical expedient if the ‘second wave’ rent concession related to a different retail store (e.g., Retail Store C)?

As noted above, Lessee B does not have a choice whether to apply the extended practical expedient for the rent concession of Retail Store C. Lessee B MUST apply the extended practical expedient to the rent concession for Retail Store C because it is eligible, and is a similar contract in similar circumstances to the lease for Retail Store B.

Example 3 - Lessee previously was not eligible for the original practical expedient but is now eligible for the extended practical expedient

Lessee C receives a ‘first wave’ COVID-19-related rent concession for its Retail Store C in Shopping Centre C. The rent concession results in a reduction in lease payments originally due before 30 June 2022. Lessee C was therefore not eligible to apply the original practical expedient in its 30 June 2020 financial statements and accounted for the rent concession as a lease modification.

At 30 June 2020, Lessee C has entered into several leases for retail stores but only received a rent concession for Retail Store C.

Can Lessee C choose to apply the extended practical expedient to the rent concession for Retail Store C in its 30 June 2021 financial statements, even though it was ineligible to apply the original practical expedient in its 30 June 2020 financial statements?

Yes. Lessee C had received no other rent concessions at 30 June 2020 so had not determined whether to apply the original practical expedient, or not. Lessee C therefore has a choice in its 30 June 2021 financial statements whether to apply the extended practical expedient, or instead continue accounting for the rent concession as a lease modification.

How would Lessee C account for the rent concession using the extended practical expedient?

Lessee C accounted for the lease modification in its 30 June 2020 financial statements by making the following adjustments on the date the rent concession was agreed with the lessor:

- Reducing the lease liability to reflect the modified lease payments

- Applying a revised discount rate to the reduced lease payments

- Reducing the right-of-use assets for the effect of (a) and (b) above.

Lessee C then would have reduced the amortisation expense on the right-of-use asset from the date of the rent concession to 30 June 2020.

The extended practical expedient is applied retrospectively, with the cumulative effect of any adjustments required recognised in retained earnings at the beginning of the annual period in which the lessee first applies the extended practical expedient (in this case, 1 July 2020). The above adjustments are therefore ‘unwound’ on 1 July 2020 as if the rent concession was always accounted for using the practical expedient. Comparatives are therefore not restated.

Resources

BDO has published a number of resources to guide lessees and lessors through accounting for rent concessions.

Lessees

Our Accounting Alert articles in July 2020 and August 2020 include examples to demonstrate accounting for rent concessions where the practical expedient is applied and the concession is received by way of:

- A waiver of certain rental payments

- A deferral of rental payments

- A mixture of both

- Deferral of rental payments for six months and lease term extended by six months, and

- Deferral of rental payments for six months, which are recouped over the remainder of lease, with additional interest on deferred payments to compensate for time value of money.

Our International Financial Reporting Bulletins also answer your questions with respect to rent concession accounting by lessees:

- Accounting for lessee rent concessions: FAQs (IFRB 2020/11), and

- COVID-19-related rent concessions beyond 30 June 2021: Extension of practical expedient – Additional FAQs (IFRB 2021/08).

Lessors

Lessors should refer to the following BDO Accounting Alert articles for more guidance on accounting for rent concessions from a lessor perspective, as well as other COVID-19 related issues:

- How should lessors account for operating lease straight-line rentals and lease incentive assets after initial recognition? (February 2021)

- Implications of COVID-19 for lessors – Your questions answered (August 2020)

Need assistance?

Please contact BDO’s IFRS Advisory team if you require assistance with lease accounting.

For more on the above, please contact your local BDO representative.

This publication has been carefully prepared, but is general commentary only. This publication is not legal or financial advice and should not be relied upon as such. The information in this publication is subject to change at any time and therefore we give no assurance or warranty that the information is current when read. The publication cannot be relied upon to cover any specific situation and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact the BDO member firms in New Zealand to discuss these matters in the context of your particular circumstances.

BDO New Zealand and each BDO member firm in New Zealand, their partners and/or directors, employees and agents do not give any warranty as to the accuracy, reliability or completeness of information contained in this article nor do they accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it, except in so far as any liability under statute cannot be excluded. Read full Disclaimer.