Implications of COVID-19 for lessors - Your questions answered

While recent changes to IFRS 16 Leases include a practical expedient to simplify the accounting by lessees receiving COVID-19-related rent concessions, no similar leniency has been provided for lessors. Further, IFRS 16 provides no specific guidance as to how lessors should account for rent concessions and other implications of IFRS 16 arising from COVID-19.

BDO recently issued International Financial Reporting Bulletin, IFRB 2020 12 Implications of COVID-19 for Lessors (IFRS 16) to answer many questions lessors may have when accounting for the impacts of COVID-19.This article summarises the key points from these resources.

BDO’s IFRB 2020 12 Implications of COVID-19 for Lessors (IFRS 16) contains three sections of FAQs as follows:

- Section 1 – Operating lease FAQs

- Section 2 – Operating lease – Modification FAQs

- Section 3 – Finance lease FAQs.

The table below provides a brief summary of general lessor accounting questions relating to operating leases that are included in that publication.

|

FAQ |

Question |

Brief summary of answer (please refer to IFRB 2020 12) for more information |

|

1.1 |

What approaches are permitted for recognising operating lease income when the collectability of lease payments is uncertain? |

Approach 1 (BDO’s preferred approach) Continue recognising lease income and test the lease receivable for impairment (see FAQ 1.2 below) Approach 2 Only recognise operating lease income to the extent lessor believes it is collectible. Note: Approach 1 is the preferred approach because IFRS 16 does not require a collectability criterion to be met in order to recognise lease income. IFRS 16 contains requirements for income recognition, therefore analogising to other IFRS (e.g. IFRS 15) is not appropriate. |

|

1.2 |

How does a lessor account for operating lease receivables after initial recognition? |

|

|

1.3 |

Can lessors change the basis over which they recognise operating lease income where the effects of COVID-19 have caused lessors to restrict access to underlying assets (e.g. from a straight-line basis to another systematic basis that is more representative of the pattern in which the benefit from using the underlying asset is diminished)? |

|

|

1.4 |

Can lessors suspend or modify the basis for depreciating the underlying asset (e.g. a building when tenants are not permitted to access due to government lockdowns)? |

Generally ‘no’.

|

|

1.5 |

What is a lease modification |

Lease modification

In New Zealand, Government has not mandated any concessions. They have merely suggested that landlords and tenants negotiate rent concessions. Not a lease modification

Note: ‘Force majeure’ clauses need to be examined carefully to determine whether rent concessions granted due to COVID were contemplated in the original lease contract in order to determine if there is a lease modification. |

|

1.6 |

How does a lessor account for a change in consideration that is not a lease modification? |

|

BDO’s operating lease FAQs – Modifications

The table below provides a brief summary of lessor accounting questions relating to modifications of operating leases that are included in IFRB 2020 12 Implications of COVID-19 for Lessors (IFRS 16).

|

FAQ |

Question |

Brief summary of answer (please refer to IFRB 2020 12) for more information |

|

2.1 |

How does a lessor account for changes in operating lease payments that are due and receivable where there has been a lease modification? |

Approach 1

Approach 2 (forgiveness = a modification)

|

|

2.2 |

How does a lessor account for changes in operating lease payments relating to future periods? |

|

|

2.3 |

How does a lessor account for unamortised lease incentives at modification date and on a go forward basis? |

|

|

2.4 |

How does a lessor account for a change in timing of lease payments when the nominal cash flows are unchanged? |

|

BDO’s finance lease FAQs

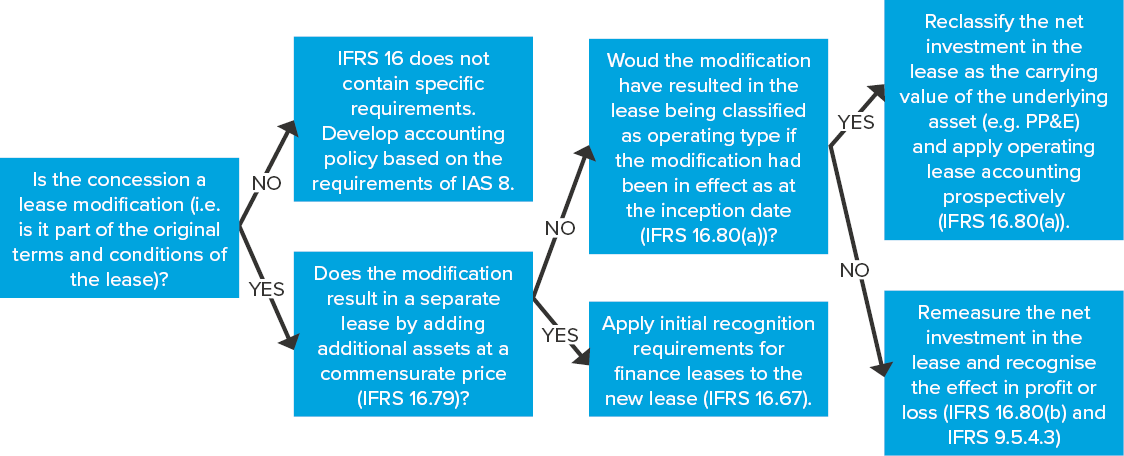

FAQ 3.1 addresses questions of how lessors account for a modification to a finance lease which are summarised on the diagram below.

If the modification is accounted for as a separate lease, the usual requirements for finance lease accounting by lessors will apply (refer IFRS 16, paragraph 67).

However, if a lease modification is not accounted for as a separate lease, then the effect of the lease modification will depend on whether the lease modification would have resulted in the lease still being classified as a finance lease if that modification had been in effect at inception:

- If the lease modification resulted in reduced consideration, and this change would have resulted in the lease being classified as an operating lease at the inception of the lease, then no immediate effect in profit or loss is recorded because the net investment in the lease is reclassified as property, plant and equipment and operating lease accounting commences on a prospective basis.

- If the reduction in consideration would have resulted in the lease remaining as a finance lease, the effect of the lease modification is immediately recorded in profit or loss. This is because IFRS 16 requires IFRS 9, paragraph.5.4.3 to be applied. The gross carrying amount is recalculated based on the present value of the renegotiated or modified contractual cash flows, discounted using the original effective interest rate, and any differences are recognised in profit or loss.

Need help?

If you require assistance determining the appropriate lessor accounting for COVID-19 impacts, please contact BDO’s IFRS Advisory Team.