Accounting for revenue under IFRS 15 – Complexity from the very first step

Last month, our Accounting Alert article discussed the five step model for revenue recognition introduced by IFRS 15 Revenue from Contracts with Customers (“IFRS 15”):Step one requires the entity to identify the contract(s) with the customer. That sounds like an easy process, but there are three potential problems that can arise:

- Determining whether a contract exists

- Deciding whether multiple contracts need to be combined, and

- Determining how to account for a modification of a contract.

Determining whether a contract exists

| IFRS 15 defines a contract as “an agreement between two or more parties that creates enforceable rights and obligations”. |

Contracts can be written, verbal, or implied by an entity’s customary business practices. Contracts can also have a fixed term or an open term and, where renewal is possible, may renew automatically or after renegotiation.

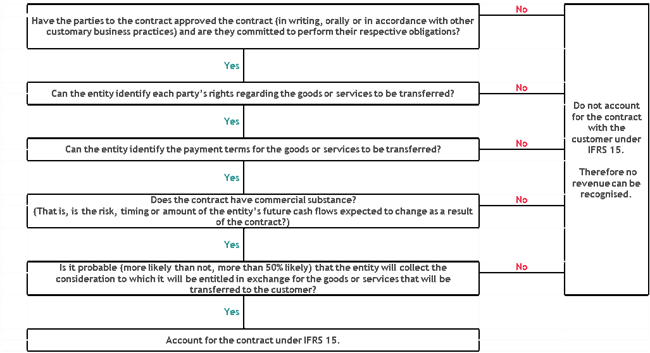

Under IFRS 15, a contract is only accounted for by an entity when all of the following requirements are met:

- The parties to the contract have approved the contract and are committed to perform their respective obligations

- The entity can identify each party’s rights regarding the goods or services to be transferred

- The entity can identify the payment terms for the goods or services to be transferred

- The contract has commercial substance (i.e. the risk, timing or amount of the entity’s future cash flows are expected to change as a result of the contract)

- It is probable that the entity will collect the consideration to which it will be entitled in exchange for the goods or services that will be transferred to the customer.

With respect to the last criterion, in evaluating whether collectability of an amount of consideration is probable, an entity must consider only the customer’s ability and intention to pay that amount of consideration when it is due.

If consideration is received from a customer prior to all of these criteria being met, it must be recognised as a liability. That consideration can only be recognised as revenue when one of the following occurs:

- The above criteria are met

- The contract has been terminated and the consideration received from the customer is non-refundable

- The entity has no remaining obligations to the customer and substantially all of the consideration promised has been received and is non-refundable.

Example

Seller Company, a property developer, sells a building for $1,000,000 to Buyer.The building cost Seller Company $600,000 to construct.

The building is located in a retail precinct that Seller Company has been developing and selling over the last few years.

Buyer plans to use the building as a retail outlet for men’s clothing. In the retail precinct there are several established men’s clothing stores, many of which are struggling due to increases in online shopping by their target demographic. In addition, Buyer has limited experience in retail.

Buyer does not have the capacity to buy the building outright, nor does it have any other income sources, and it has been unable to secure a bank loan for the purchase of the building. Due to those factors, Seller Company will take a non-refundable deposit of $50,000 from Buyer, and enter into a long-term financing agreement with Buyer for the remaining 95% of the promised consideration.

The financing arrangement is provided on a non-recourse basis (which means that if Buyer defaults, Seller Company can repossess the building, but cannot seek further compensation from Buyer, even if the collateral does not cover the full value of the amount owed).

All payments made by Buyer are non-refundable.

On the sale date, Buyer pays the deposit and obtains control of the building.

Is there a contract?

In assessing whether a contract with a customer exists, Seller Company must assess, among other things, whether it is probable that it will be able to collect the consideration to which it is entitled. In making this assessment, the factors that Seller Company will consider are:- Buyer intends to repay the loan from income derived from its retail business (which is a business facing significant risks because of high competition in the retail precinct and from online retailers and Buyer’s limited retail experience)

- Buyer appears to lack other income or assets that could be used to pay the remainder of the consideration for the building

- Buyer’s liability under the loan is limited (because the loan is non-recourse).

Seller Company then continues to account for the initial deposit, as well as any future payments received from Buyer, as a liability, until:

- Seller Company is able to conclude that it is probable that it will collect the consideration to which it is entitled

- The contract has been terminated, or

- Substantially all of the consideration promised has been received.

Deciding whether multiple contracts need to be combined

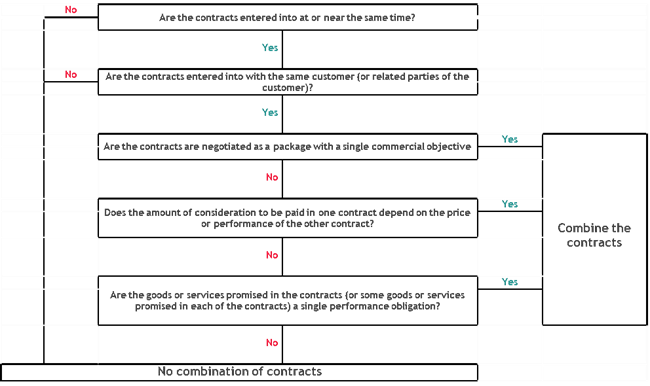

Under IFRS 15, an entity must combine two or more contracts entered into at or near the same time with the same customer (or related parties of the customer) and account for the contracts as a single contract if one or more of the following criteria are met:- The contracts are negotiated as a package with a single commercial objective

- The amount of consideration to be paid in one contract depends on the price or performance of the other contract

- The goods or services promised in the contracts (or some goods or services promised in each of the contracts) are a single performance obligation (i.e. a single promise to a customer to do something, such as provide a product or deliver a service).

This requirement means that companies must have a robust process for tracking the contracts that they enter into with their customers, in order to:

- Understand which customers are related parties of each other, and

- Assess the commercial intent of contracts entered into at or near the same time with a customer.

Determining how to account for a modification of a contract

When there is a modification to the scope and/or pricing of a contract with a customer, the modification may be accounted for either as a change in the original contract, or the issue of a new contract, depending on the underlying facts and circumstances.In future editions of Accounting Alert we will provide some examples of the impacts of contract modification.

Concluding thoughts

The first step in the IFRS 15 five step revenue recognition model is often considered to be the easiest. However, in some instances the requirements of this step will mean that revenue recognition lags behind the receipt of cash, while in other instances the requirements of this step will result in multiple contracts being entered into with one customer (or, in some cases, different customers that are related parties of each other) needing to be considered as one contract.As always with IFRS 15, it is important for businesses to have an in-depth understanding of the nuances of their relationships with their customers. Until recently, it has been common for sales people and account managers to have an in-depth understanding of the company’s relationships with its customers, while the accounting team has had a more overarching, and less detailed, understanding of those relationships. As companies move to adopt IFRS 15, it will be important for accounting teams to work with sales teams to gain a detailed understanding of the company’s relationships with its customers.

For more on the above, please contact your local BDO representative.