Determining a lessee’s incremental borrowing rate – Examples

When measuring its lease liability, a lessee discounts its remaining lease payments using the interest rate implicit in the lease, or if that rate cannot be readily determined, it uses its incremental borrowing rate (IBR).

In our April 2020 edition of Accounting Alert, we dispelled several myths about how the IBR should be determined, and concluded that:

- The IBR is not simply the interest rate that an entity pays on its other debts

- An entity cannot necessarily use the same IBR for all of its leases, and

- There are practical expedients in IFRS 16 to simplify the process for determining IBR’s for each individual lease.

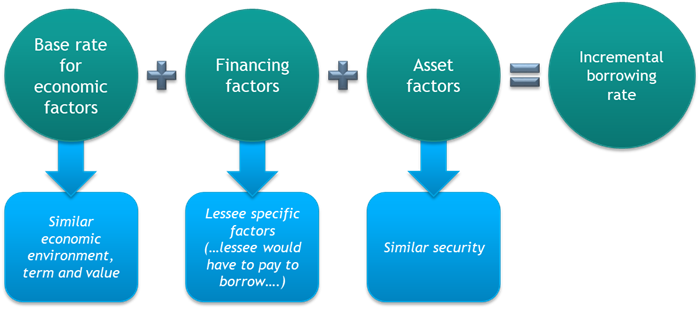

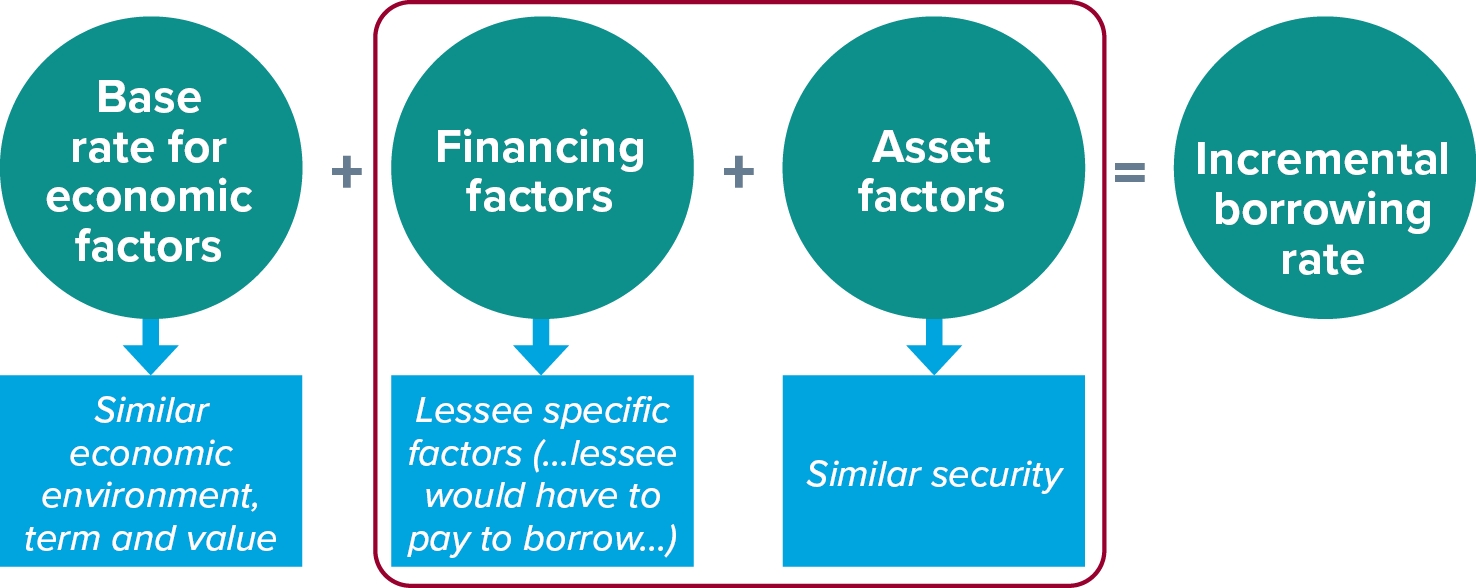

We also considered how an entity should estimate its IBR for a new lease or portfolio of similar leases. A common approach is to determine a ‘base rate’ (or ‘reference rate’) based on readily observable interest rates for public or liquid corporate debt and adjust that rate for relevant factors. A graphical illustration of this approach, and how it is consistent with the definition of the IBR, can be presented as):

This article looks in more detail, using examples to illustrate, at issues to consider when determining the IBR.

Base rate for economic factors – similar economic environment, term and value

When estimating the IBR, we start with a ‘base rate’, which may be a risk-free rate derived from government bonds or other types of low-risk financing. To achieve a similar economic environment, this ‘base rate’ should consider:

- The applicable geographic location where the lessee operates

- The lease term (i.e. the risk-free rate for a 3-year lease of equipment would be less than for a 20-year real estate lease as the cost of borrowing tends to increase as the period pf time increases)

- Timing of payments - There are significant differences between the timing of cash flows between risk-free loans and leases. Low risk lending arrangements, such as government bonds, tend to have payments heavily weighted towards the end of the term, i.e. ‘bullet loans’, whereas payments for leases tend to be consistent throughout the period of the lease.

Example 1 – Bullet loans

Lessee A enters into a 15-year lease for a commercial property in New Zealand.

Lease payments are made on a monthly basis.

The weighted average life of the lease is 11 years, i.e. the weighted average life of the lease represents the length of time it will take Lessee A to repay approximately half of the principal amount of the lease liability.

Lessee A cannot readily observe a borrowing rate for a similar amortising loan (i.e. one which has repayment of principal and interest on a monthly basis). It can only observe borrowing rates for bullet loans in New Zealand with a:

- 10-year maturity

- 15-year maturity.

A bullet loan is a loan with a single balloon payment at the end of the loan, or payment of interest on a monthly basis with a balloon repayment of principal due only at the end of the loan.

Analysis

The rate on the 15-year bullet loan is for the same geographic environment as the leased asset and for a similar term (the lease is for 15 years). However, the payment profile of the bullet loan is skewed towards the end of the loan whereas lease payments in this example are paid on a monthly basis.

Lessee A should not automatically use the 15-year bullet loan rate as its IBR, however it may use this rate as a starting point to calculate its IBR.

The rate of interest that a lessee would have to pay to borrow over a similar term, and with a similar security, the funds necessary to obtain an asset of a similar value to the right-of-use asset in a similar economic environment. Definition of IBR - IFRS 16 Appendix AThe IFRS Interpretations Committee (IFRIC) considered a similar question at its September 2019 meeting, where it was asked if a lessee’s IBR is required to reflect the interest rate in a loan with both a similar maturity to the lease, and a similar payment profile to the lease’. The IFRIC noted that:

- Basis for Conclusions to IFRS 16, paragraph BC162 explains that depending on the nature of the underlying asset and the terms and conditions of the lease, a lessee may be able to refer to a rate that is readily observable as a starting point. A lessee would then adjust such an observable rate as is needed to determine its incremental borrowing rate as defined in IFRS 16, and

- The definition of a lessee’s IBR in IFRS 16 does not explicitly require the IBR to reflect the interest rate in a loan with a similar payment profile to the lease payments however, it would be consistent with the IASB’s objective when developing the definition of IBR for a lessee to refer, as a starting point, to a readily observable rate for a loan with a similar payment profile to that of the lease (i.e. in this case, the bullet loan with a 15-year maturity).

In this case, Lessee A would need to apply judgement when determining the IBR. Lessee A may determine that it is more appropriate to use the 10-year bullet rate as a starting point when calculating the IBR because the term of the loan is more closely related to the weighted average life of the lease. However, Lessee A would also need to adjust this rate to account for other factors such as:

- The rate not being an amortising rate, i.e. it may be higher than if an amortising rate was used

- Financing factors – such as Lessee A’s credit risk, and

- Asset factors – whether the rate is for an asset with similar security.

Financing factors

A common approach used to determine the IBR is to determine a ‘base rate’ based on readily observable interest rates for public or liquid corporate debt and then adjust that rate for other relevant factors such as financing and asset factors.

|

Factor |

Practical considerations |

|

Credit risk |

For entities that issue listed debt themselves, it would not be appropriate to use the unadjusted interest rate payable on those instruments for the IBR. That is because IFRS 16 contemplates that a lease is a secured borrowing, which would be dissimilar to the interest rate paid on listed debt. |

|

Liquidity risk |

Depending on how an entity incorporates entity-specific credit risk into the IBR, the incorporation of credit risk may implicitly consider liquidity risk. |

Asset factors

A lease is essentially a borrowing that is secured by the underlying right-of-use asset, with the lessor typically having recourse to repossess the underlying right-of-use asset if the lessee defaults. The IBR is therefore adjusted downward to reflect this security, however, this adjustment would be different for different asset types, and would depend on the lessor’s ability to realise a residual amount from the underlying collateral, and at what cost.

Other factors to consider – Use of WACC not appropriate

An entity’s weighted-average cost of capital (WACC) is not appropriate to use as a proxy for the IBR because it is not representative of the rate an entity would pay on borrowings. WACC incorporates the cost of equity-based capital, which is unsecured and ranks behind other creditors and will therefore be a higher rate than that paid on borrowings. The use of WACC would therefore result in the carrying amounts of both lease liabilities and right-of-use assets being understated.

Example 2 – Using WACC as the IBRBioMed Co is a start-up entity in the biomedical industry. It has no borrowings due to it having a very high risk of default on loans, making it unattractive for traditional lending. It is therefore financed entirely by equity.

BioMed Co enters into a lease and uses its cost of capital as its IBR.

Analysis

It is unlikely that the WACCC would meet the definition of the lessee’s IBR (refer to Appendix A of IFRS 16), except in very specific circumstances.

Because of its high risk of default, after adjusting for Biomed Co’s credit characteristics, the IBR may be close to its equity cost of capital, since the nature of a loan (including a lease) to an entity with extremely high credit risk is, in practical terms, close to that of an equity investment.

Note: Cases such as these would generally be rare and careful consideration would be required to determine that a rate similar to the equity cost of capital is appropriate.

For more on the above, please contact your local BDO representative.