Public benefits entities: Classification of joint arrangements

In the March 2019 edition of Accounting Alert we noted that PBE IPSAS 37 Joint Arrangements (“PBE IPSAS 37”), which is in effect for Tier 1 and Tier 2 public benefit entities (“PBEs”) for annual financial reporting periods beginning on or after 1 January 2019, does three primary things:

- Defines what constitutes a joint arrangement

- Defines the two different types of joint arrangement

- Provides the accounting requirements for each of the two types of joint arrangement.

In the March 2019 edition of Accounting Alert we examined how to determine whether joint control exists. Under PBE IPSAS 37, joint control exists when decisions about the relevant activities require the unanimous consent of the parties sharing control. This means that joint control only exists where all the parties, or a group of the parties, to an arrangement must act together to direct the relevant activities (which are those activities that significantly affect the nature or amount of the benefits from their involvement with the arrangement).

Classification of joint arrangements

Once it has been established that there is joint control of an arrangement, the joint arrangement must be classified.

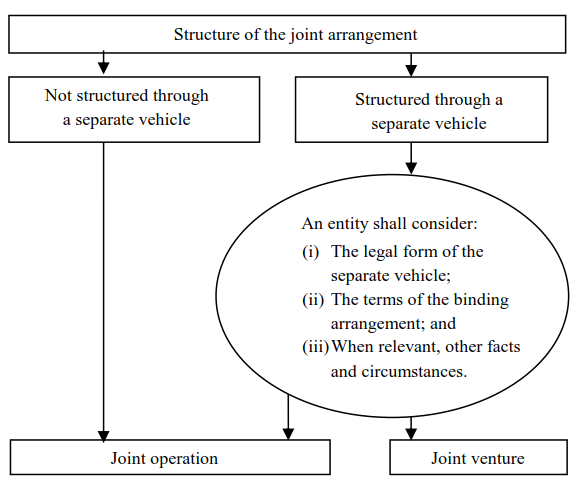

Under PBE IPSAS 8 Interests in Joint Ventures there were three available classifications - jointly controlled assets, jointly controlled operations and jointly controlled entities. However, under PBE IPSAS 37 there are only two available classifications for a joint arrangement - joint operations and joint ventures. Classification depends on the rights and obligations of the parties to the arrangement, as shown in the diagram below:

- When an entity has rights to the assets, and obligations for the liabilities, relating to the arrangement, the arrangement is a joint operation

- When an entity has rights to the net assets of the arrangement, the arrangement is a joint venture.

When assessing their rights and obligations under an arrangement, the parties to the arrangement should consider the structure of the joint arrangement (i.e. whether it is a separate vehicle). A joint arrangement that is not structured through a separate vehicle is a joint operation. In such cases, the binding arrangement establishes the parties’ rights to the assets, and obligations for the liabilities, relating to the arrangement, and the parties’ rights to the corresponding revenues and obligations for the corresponding expenses.

When a joint arrangement is structured through a separate vehicle, the joint arrangement can be either a joint operation or a joint venture. In such instances, parties to the joint arrangement must also examine the following to determine how the joint arrangement should be classified:

- The legal form of that separate vehicle

- The terms of the binding arrangement

- Where relevant, other facts and circumstances.

The purpose of undertaking such an examination is to determine if the factors outlined above:

The factors that need to be considered when determining the classification of a joint arrangement are illustrated in the diagram below (extracted from PBE IPSAS 37):

As shown in the diagram, where a joint arrangements is not structured through a separate vehicle, the arrangement is a joint operation. Where the joint arrangement is structured through a separate vehicle, the legal form of the separate vehicle, the terms of the binding agreement and other facts and circumstances need to be assessed to determine whether the arrangement is a joint operation or a joint venture.

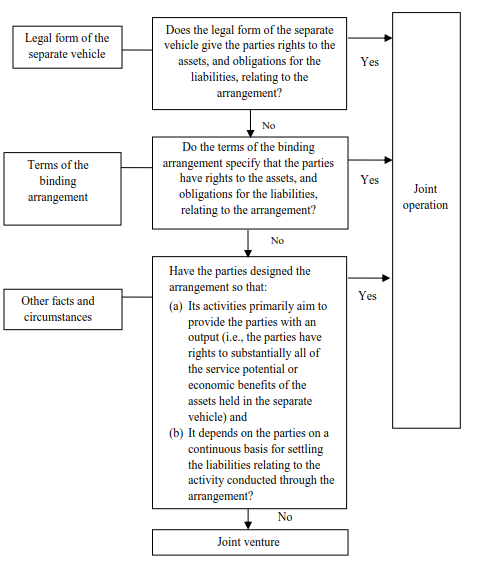

Assessing the legal form of the separate vehicle

The legal form of some vehicles, such as registered companies, causes the separate vehicle to be considered in its own right (i.e. the assets and liabilities held in the separate vehicle are the assets and liabilities of the separate vehicle and not the assets and liabilities of the investors in/owners of that vehicle). In such instances, the assessment of the rights and obligations conferred upon the parties by the legal form of the separate vehicle indicates that the arrangement is a joint venture.

However, in some instances the parties can contract out of such legal requirements, so that the parties have rights to the assets, and obligations for the liabilities, relating to the arrangement - where that occurs, the joint arrangement will be classified as a joint operation. For that reason, it is still important to ensure that all relevant agreements are thoroughly examined before concluding whether a joint arrangement is a joint operation or a joint venture.

Assessing the terms of the binding agreement

The agreement between the parties to the joint arrangement will ordinarily establish whether the parties have rights to the assets, and obligations for the liabilities, of the joint arrangement or rights to the net assets of the arrangement. The table below compares common terms in the agreements of joint operations with common terms in the agreements of joint ventures:

|

|

Joint operation |

Joint venture |

|---|---|---|

|

Terms of the arrangement |

The parties to the joint arrangement have rights to the assets, and obligations for the liabilities, relating to the arrangement. |

The parties to the joint arrangement have rights to the net assets of the arrangement (i.e. the separate vehicle, not the parties, has rights to the assets, and obligations for the liabilities, relating to the arrangement). |

|

Rights to assets |

The parties to the joint arrangement share all interests (such as rights, title or ownership) in the assets relating to the joint arrangement in a specified proportion (such as in proportion to the parties’ ownership interests in the joint arrangement). |

The assets brought into the joint arrangement, or subsequently acquired by the joint arrangement, are the joint arrangement’s assets (i.e. the parties to the joint arrangement do not have rights in, title to, or ownership of, the assets of the joint arrangement). |

|

Obligations for liabilities |

The parties to the joint arrangement share all liabilities, obligations, costs and expenses in a specified proportion (such as in proportion to the parties’ ownership interests in the joint arrangement). |

The joint arrangement is liable for the debts and obligations of the arrangement. and/or The parties to the joint arrangement are liable to the joint arrangement only to the extent of their respective investments in the joint arrangement or to their respective obligations to contribute any unpaid or additional capital to the joint arrangement, or both. |

|

The parties to the joint arrangement are liable for claims raised by third parties. |

Creditors of the joint arrangement do not have rights of recourse against any other party with respect to debts or obligations of the arrangement. |

|

|

Revenues, expenses, surplus or deficit |

Revenues and expenses of the joint arrangement are allocated to the parties to the joint arrangement on the basis of the relative performance of each party (for example, they might be allocated on the basis of the capacity that each party uses in a plant that is operated jointly).

In other instances, the surplus or deficit relating to the joint arrangement might be allocated between the parties in a specified proportion (such as in proportion to the parties’ ownership interests in the joint arrangement). This would not prevent the joint arrangement from being a joint operation if the parties had rights to the assets, and obligations for the liabilities, relating to the joint arrangement. |

Each party’s share in the surplus or deficit relating to the activities of the arrangement is specified. |

In many instances the parties to a joint arrangement are required to provide guarantees to third parties that, for example, receive a service from, or provide financing to, the joint arrangement. The provision of such guarantees, or the commitment by the parties to provide them, does not, by itself, assist with the classification of a joint arrangement – it is the obligation for the underlying liabilities that should be considered when determining the classification.

Assessing other facts and circumstances

As outlined above, a joint arrangement would ordinarily be structured as a joint venture if the following applied:

- The joint arrangement was structured in a separate vehicle whose legal form conferred separation between the parties and the separate vehicle

- The agreement between the parties to the joint arrangement did not specify the individual parties’ rights to the assets, and obligations for the liabilities, of the joint arrangement.

However, it could still be possible that other facts and circumstances would lead to such a joint arrangement being classified as a joint operation. For example, when the activities of a joint arrangement are primarily designed for the provision of output to the parties to the joint arrangement, it often means that the parties have rights to substantially all of the service potential or economic benefits of the assets of the arrangement. The effect of an arrangement with such a design and purpose is that the liabilities incurred by the joint arrangement are, in substance, satisfied by the cash flows received from the parties to the joint arrangement through their purchases of the output, which indicates that the parties have an obligation for the liabilities relating to the arrangement, which could result in classification of the joint arrangement as a joint operation.

The process for determining the classification of a joint arrangement that is structured through a separate vehicle is illustrated in the diagram below (which is extracted from PBE IPSAS 37):

Concluding comments

In many instances classification of a joint arrangement as a joint operation or a joint venture will be a relatively straightforward process. In other instances, however, it will be considerably more complex and require thorough examination of relevant documents, as well as consideration of the particular facts and circumstances of the arrangement. For that reason, as soon as PBEs have identified the arrangements that will be classified as joint arrangements under PBE IPSAS 37 they should commence the process of classifying those joint arrangements.

For more on the above, please contact your local BDO representative.