NZASB approves accounting relief for lessees who receive rent concessions

Following on from our article in the May 2020 edition of Accounting Alert, the amendment to provide lessees with an optional practical expedient in accounting for COVID-19-related rent concessions under NZ IFRS 16 Leases has now been approved by the New Zealand Accounting Standards Board.

Lessees may apply the amendment for annual reporting periods beginning on or after 1 June 2020, with earlier application permitted, including in annual and interim financial statements not yet authorised for issue at 11 June 2020.

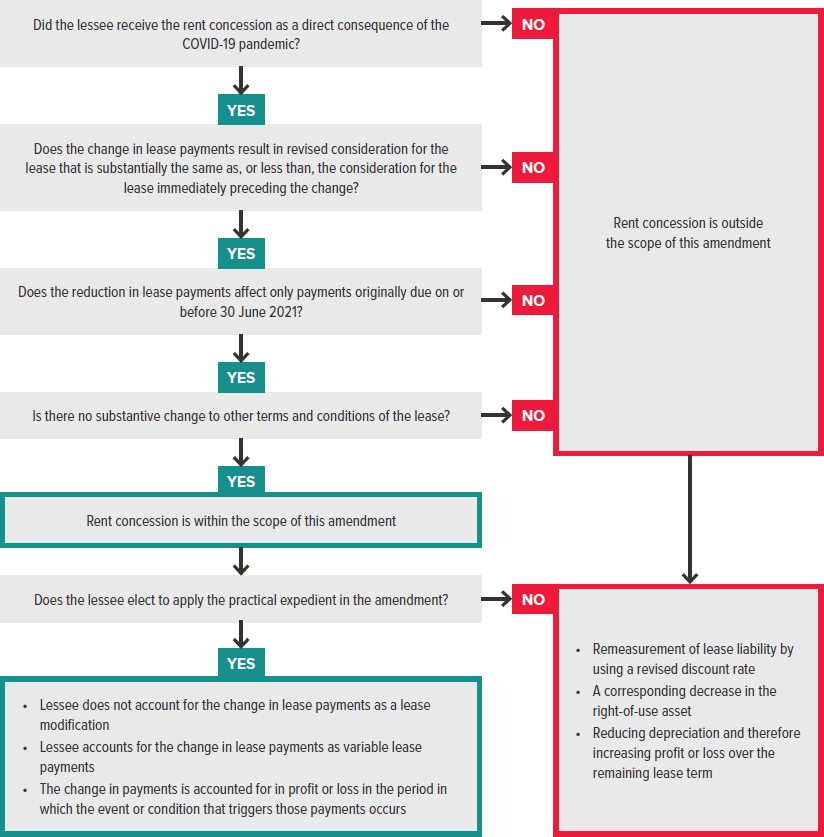

In summary, the practical expedient applies to rent concessions occurring as a direct consequence of the COVID-19 pandemic. The practical expedient may only be applied if the change in lease payments results in substantially the same (or less) consideration for the lease immediately preceding the change, and any reduction in lease payments can only affect payments originally due on or before 30 June 2021. In addition, there may be no substantive changes to other terms and conditions of the lease, otherwise the expedient may not be applied.

If the practical expedient is applied, a lessee may elect not to assess whether a COVID-19-related rent concession is a lease modification under NZ IFRS 16.

Instead, a lessee accounts for any change in lease payments resulting from COVID-19-related rent concessions as a variable lease payment, with the resultant change being recognised in profit or loss. For more detail on this amendment, please refer to our article in the May 2020 edition of Accounting Alert

For more on the above, please contact your local BDO representative.