Accounting for joint arrangements

Consolidated financial statements are required when a parent entity controls other entities. What happens if an entity does not control an entity by itself, but has joint control with another entity?

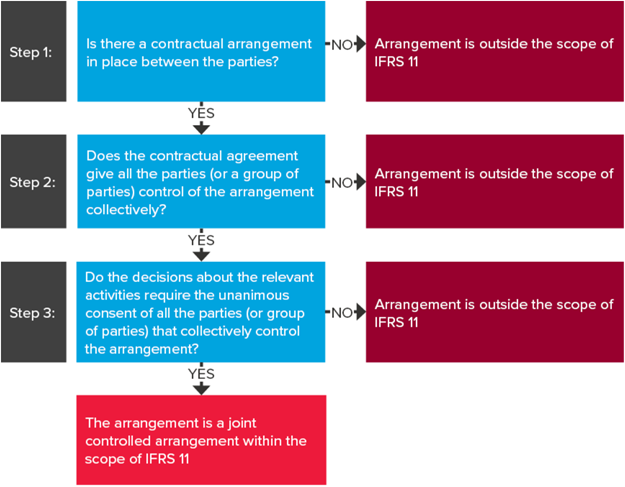

A ‘joint arrangement’ is an arrangement in which two or more parties have joint control. In order for a joint arrangement to exist:- The parties must be bound by a contractual arrangement, and

- The contractual arrangement gives the parties joint control.

What is joint control?

Joint control exists when two or more parties have contractually agreed to share control, i.e., decisions about the ‘relevant activities’ require unanimous consent of the parties sharing control.

Unanimous consent means that all parties that control the joint arrangement collectively must all agree on decisions about the ‘relevant activities’.

Not all parties to the joint arrangement need to have joint control. You could have parties that participate in, but do not have joint control of a joint arrangement.

The diagram below illustrates the process for determining whether you have a joint arrangement under IFRS 11.

Example 1

Investor A and Investor B each hold 50% of the voting rights of an investee.

The contractual arrangement between Investor A and Investor B requires at least 51% of the votes to make decisions about the relevant activities.

Investor A and Investor B have joint control over the investee because unanimous consent is required (i.e., both parties must agree) on decisions about the relevant activities.

Example 2

Investor A holds 50% of the voting rights of an investee, Investor B holds 30% and Investor C holds 20%.

The constitution of the investee requires at least 75% of the voting rights to make decisions about relevant activities of the investee. There is no contractual arrangements between any of the investors to agree to vote together on decisions about relevant activities.

In this example, none of the investors individually control the investee. Nor do any of the investors collectively have joint control because there is no contractual arrangement to act collectively. A contractual arrangement would be needed between Investors A and B to act jointly in order for there to be joint control over this investee.

What are ‘relevant activities’?

The terminology contained in IFRS 11 regarding ‘control, ‘relevant activities, etc. is explained further in IFRS 10 Consolidated Financial Statements.

It should be noted that determining the relevant activities can sometimes be a tricky and judgemental task and determining whether an entity has power (substantive rights rather than protective rights) is also a difficult area.

Force majeure

Unanimous consent is required when making decisions about the relevant activities of the joint arrangement, but what happens if one party decides to oppose decisions proposed by others with joint control?

Such a ‘stalemate’ situation is untenable as it would hamper progress, therefore we need to examine joint arrangement contracts carefully to determine whether there is, in fact, joint control.

If any of the following ‘force majeure’ clauses are present, it could indicate that there is no joint control if stalemate situations are resolved by:

- Resorting to absolute voting rights, or

- The Chairperson gets a casting vote.

However, if an independent arbitrator is appointed to resolve conflicts then it is likely that joint control still exists.

Types of joint arrangements

Once you have established that you have a joint arrangement (i.e. are within the scope of IFRS 11), you then need to determine what type of joint arrangement you have because the accounting is different. There are two types of joint arrangements: joint operations and joint ventures.

Joint operation

In a ‘joint operation’, the parties with joint control have right to the assets, and obligations for the liabilities of the joint arrangement. These parties are called ‘joint operators’.

Joint operations are not structured through a separate vehicle.Joint venture

A ‘joint venture’ is a joint arrangement where the parties with joint control have rights to the net assets of the arrangement. These parties are called ‘joint venturers’.

Joint arrangements structured through a separate vehicle such as a company, partnership or trust can be either a ‘joint operation’ or a ‘joint venture’ so further analysis is required to assess rights and obligations of the parties to the joint arrangement, including consideration of:- The structure and legal form of the arrangement

- Contractual terms of the arrangement, and

- When relevant, other facts and circumstances.

This is illustrated on the decision tree below.

A joint arrangement is only classified as a ‘joint venture’ if at each stage of the above decision tree, there is nothing to indicate that the parties to the joint arrangement have rights and obligations over the gross assets and liabilities respectively.

Decisions about what type of joint arrangement you have can be quite judgemental and the relevant considerations should be disclosed in the financial statements as a significant judgement.

Example 3 – Other facts and circumstances

Investors A and B each own 50% of the shares in Joint Venture Company (company), which is a separate vehicle set up to manufacture materials required by Investors A and B in their own individual manufacturing processes.

Investors A and B operate the facility that produces the materials to the quantity and quality specifications set by themselves and agree that:

- Each of them will purchase all of the output produced by company 50:50

- The company cannot sell any output to third parties unless approved by Investors A and B

- The price of the output to Investors A and B is set to cover production costs and administration expenses incurred by the company

- The company will operate on a break-even basis.

Analysis

Working through the decision tree above:

- Joint Venture Company is structured through a separate vehicle so further analysis is needed to determine whether it is a joint operation or a joint venture

- The legal form of Joint Venture Company is that the assets and liabilities are those of the company and ordinarily, Investors A and B would simply be

entitled to the net assets of the company, and - There are no contractual agreements that give Investors A and B rights and obligations over the gross assets and liabilities of the company.

However, the fact pattern notes that:

- Investors A and B have an obligation to purchase all the output of the company. This indicates that the company depends on Investors A and B for cash, and Investors A and B are therefore responsible for the liabilities of the company.

- As Investors A and B have rights to all the output of the company, they are consuming all the assets of the company, which indicates that they have rights to the gross assets, not to the net assets of the company.

In this case, Joint Venture Company is likely to be a joint operation.

Accounting for joint arrangements

As noted earlier, we account for joint operations and joint ventures differently as shown on the decision tree below.

Joint operations

A joint operator accounts for its interests in a joint operation by recognising:

- Its own assets and its share of any assets held jointly

- Its own liabilities and its share of any liabilities incurred jointly

- Its own revenue from the sale of its share of the output arising from the joint operation

- Its share of the revenue from the sale of the output by the joint operation, and

- Its own expenses and its share of any expenses incurred jointly.

As there is no ‘group’ to speak of, accounting for the joint operation in the joint operator’s separate and group financial statements is identical.

Joint ventures

Generally, joint venturers account for their investments in joint ventures using the equity method in IAS 28 Investments in Associates and Joint Ventures in their group financial statements. In the separate financial statements, joint venturers can choose to measure the investment in the joint venture (i) at cost, (ii) in accordance with IFRS 9 Financial Instruments (i.e. at fair value through profit or loss or fair value through other comprehensive income), or (iii) using the equity method.

Resources - Publications

You can find more information about IFRS 11, including examples in our IFRS in Practice.

For more on the above, please contact your local BDO Representative.

This publication has been carefully prepared, but is general commentary only. This publication is not legal or financial advice and should not be relied upon as such. The information in this publication is subject to change at any time and therefore we give no assurance or warranty that the information is current when read. The publication cannot be relied upon to cover any specific situation and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact the BDO member firms in New Zealand to discuss these matters in the context of your particular circumstances.

BDO New Zealand and each BDO member firm in New Zealand, their partners and/or directors, employees and agents do not give any warranty as to the accuracy, reliability or completeness of information contained in this article nor do they accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it, except in so far as any liability under statute cannot be excluded. Read full Disclaimer.