Booking insurance contracts – It’s all in the timing

As we mentioned in the June 2021 article, over the coming months we will focus on the recognition, measurement, presentation and disclosure requirements in IFRS 17. To assist those entities transitioning from IFRS 4 Insurance Contracts, we will highlight some of the main differences between the recognition, measurement and presentation requirements in IFRS 4 and the corresponding requirements in IFRS 17.

To assist those readers not directly involved with insurance contracts, but who are interested in understanding the implications of IFRS 17, we will also discuss some of the ways in which the requirements in IFRS 17 differ from the corresponding requirements in other International Financial Reporting Standards (IFRS) that cover similar types of transactions and events, such as IAS 19 Employee Benefits (as it applies to defined benefit obligations) and IAS 37 Provisions, Contingent Liabilities and Contingent Assets.

Recognition criteria

To paraphrase the Conceptual Framework for Financial Reporting (the Conceptual Framework), recognition is the process of capturing for inclusion in the financial statements an item that meets the definition of one of the ‘elements’ of financial statements (asset, liability, equity, income or expense).

The Conceptual Framework also clarifies that an asset or liability is recognised only if recognition of that asset or liability and any resulting income expenses or changes in equity provides users of the financial statements with information that is useful. Information is considered useful to users if it provides:

- Relevant information about the asset or liability and about any resulting income, expenses or changes in equity; and

- A faithful representation of the asset or liability and of any resulting income, expenses or changes in equity (paragraphs 5.1 & 5.6).

The Conceptual Framework provides a basis on which IFRS are developed and applied. Accordingly, the recognition requirements in IFRS are generally consistent with the corresponding requirements in the Conceptual Framework. Nevertheless, subject to the nature of the element, IFRS may prescribe relatively more detailed and/or onerous recognition criteria.

Initial recognition of insurance contracts

With regards to its recognition requirements, IFRS 17 is somewhat unique within the suite of IFRS standards for a number of reasons. For instance, IFRS 17 does not refer directly to either the future economic benefits or the reliably measurable recognition criteria found in other IFRS. Consequently, like the recognition criteria in IFRS 9 Financial Instruments, the question of whether an insurance contract has a cost or other value that can be reliably measured doesn’t enter into the assessment about whether or not the item is recognised.

Also similar to the way in which the recognition criteria in IFRS 9 operate, IFRS 17 requires that an entity recognise an insurance contract when the entity is ‘on risk’ for the contract. Under IFRS 9, an entity is ‘on risk’ for a financial instrument when the entity ‘becomes party to the contractual provisions of the instrument’ (IFRS 9.3.1.1). This is typically when the entity signs or otherwise approves to be a party to the instrument. A similar approach applies in respect to insurance contracts under IFRS 17.

However, it is not uncommon for insurers to:

- Issue a contract in advance of the date when the policy coverage commences

- Become a party to an insurance contract, notwithstanding the counterparty has not formally signed an agreement with the entity. For instance, ‘covering notes’ for car and house insurance, and

- Receive the first premium from the policyholder in respect to an insurance contract before or after the insurance coverage commences.

It is also relevant to note that there might be a lag between when an entity issuing insurance contracts determines the key features and price (premiums) of the contract, and when the coverage period for the contracts commence and/or when the first premium in respect to those contracts becomes due. In such circumstances, if there is a change in the market and/or legal conditions (at the time the contracts are issued) that impact the profitability of those contracts, the entity issuing the insurance contracts might determine that some of the insurance contracts are ‘loss making’ (onerous) from the date they are issued.

An insurer might also issue loss-making insurance contracts for commercial and/or legal reasons. For instance, an insurer might be required by legislation to provide insurance coverage to all applicants (irrespective of their individual risk profile) at a fixed or regulated price, in which case the insurer knows at the outset that some of the contracts will be loss-making.

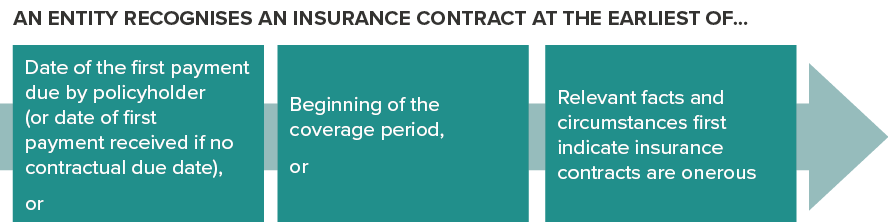

Consequently, and distinct from the requirements in IFRS 9, IFRS 17 requires an entity that issues insurance contracts to recognise such a contract from the earliest of the following:

- The beginning of the coverage period

- The date when the first payment from a policyholder becomes due, and

- For a group of onerous contracts, when the group becomes onerous.

The following diagram summarises these recognition criteria for an insurance contract under IFRS 17.

Comparing recognition criteria across comparable IFRS

Notwithstanding the similarities between the recognition criteria in IFRS 9 and IFRS 17, the recognition criteria in IFRS 17 would facilitate entities recognising insurance contracts earlier than they might otherwise if the contract was accounted for under IFRS 9. This observation is relevant to those entities who issue credit cards and similar contracts providing credit or payment arrangements that are mandatorily scoped out of IFRS 17. It is also relevant to those entities that issue contracts that meet the definition of an insurance contract but for which IFRS 17 provides the entity with an accounting policy choice between IFRS 17 and IFRS 9 (refer to our June 2021 edition of Accounting Alert).

The following table provides a summary of the recognition criteria applicable to liabilities comparable to insurance liabilities but recognised under other IFRS.

| IAS 37 Provisions, Contingent Liabilities and Contingent Assets | IAS 19 Employee Benefits (defined benefit obligations) |

| A provision shall be recognised when:

(a) an entity has a present obligation (legal or constructive) as a result of a past event; (b) it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation; and (c) a reliable estimate can be made of the amount of the obligation. If these conditions are not met, no provision shall be recognised. IAS 37.14 |

An entity initially recognises its obligation for an employee’s defined benefit entitlements when the employee first provides service that is counted towards the employee’s defined benefit entitlements, either under the formal agreement the employee is a party to or consistent with the employer sponsor’s past actions or announcements, as indicated by the following requirements.

Using an actuarial technique, the projected unit credit method, to make a reliable estimate of the ultimate cost to the entity of the benefit that an employee has earned in return for their service in the current period IAS 19.57(a)

An entity shall account not only for its legal obligation under the formal terms of a defined benefit plan, but also for any constructive obligation that arises from the entity’s informal practices. IAS 19.61 |

In contrast to IFRS 17, IFRS 4 contains no specific recognition criteria with respect to insurance contracts. In addition, IFRS 4 provides entities with an exemption from the requirements in other IFRS, including paragraphs 10-12 of IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors. Because of this exemption, entities accounting for insurance contracts under IFRS 4 are not required to consider, for instance, the requirements in other IFRS or the Conceptual Framework when developing an accounting policy for the recognition of insurance contracts. We would anticipate, therefore, that some entities transitioning from IFRS 4 to IFRS 17 might experience a change in the timing of recognition of insurance contracts under the new Standard, subject to the criteria they currently apply.

Unit of account

The concept of the ‘unit of account’ is an important concept because it establishes the boundary of the element subject to measurement. In some cases, expanding the unit of account may increase the carrying amount of an element by, for instance, encompassing additional cash inflows. In some cases, however, expanding the unit of account can reduce the overall carrying amount of an element, particularly when a consequence of expanding the boundary is the inclusion of cash outflows in the measured amount.

IFRS 17 unit of account

Many IFRS require transactions to be accounted for at the individual contract level. Accordingly, the ‘unit of account’ is the individual contract. For instance, IFRS 15 Revenue from Contracts with Customers specifies the accounting for an individual contract with a customer (IFRS 15.4). Nevertheless, IFRS 15 provides, as a practical expedient, the option of applying the Standard to a portfolio of contracts (or performance obligations) with similar characteristics if the entity reasonably expects that the effects on the financial statements would not differ materially from applying the Standard to the individual contracts (or performance obligations).

In contrast to IFRS (such as IFRS 15) that provide the ability for an entity to account for contracts on a portfolio basis, IFRS 17 requires an entity that issues insurance contracts to account for those contracts on a portfolio basis. While consistent with the manner in which most insurers manage their businesses and the risks to which they are exposed, accounting for insurance contracts at a level above the individual contract increases the probability that the net cash outflows attributable to onerous contracts will be offset (and thereby obscured) by the net cash inflows generated by profitable contracts within the same portfolio. Consequently, IFRS 17 requires that, in addition to insurance contracts being accounted for on a portfolio basis, any groups of contracts that are onerous at initial recognition be accounted for separately from other identifiable groups within the portfolio. Practically, this has a similar effect as the criteria in IFRS 15 that applying the Standard at a portfolio level does not produce materially different outcomes as compared to the outcomes from applying the Standard at the individual contract level.

Accounting for insurance contracts on a portfolio basis

IFRS 17 defines a portfolio of insurance contracts as a group of contracts that are subject to similar risks and are managed together. To assist entities in identifying separate portfolios of insurance contracts, IFRS 17 clarifies, among other things, that:

- Contracts within a product line would be expected to have similar risks and therefore would be expected to be in the same portfolio if they were managed together, and

- Contracts in different product lines (for instance, single premium fixed annuities compared with regular term life assurance) would not be expected to have similar risks and therefore would be expected to be in different portfolios.

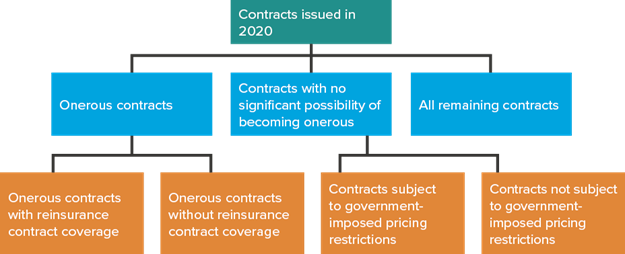

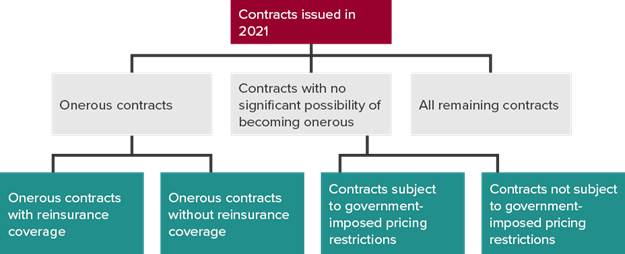

To prevent the type of ‘offsetting’ within portfolios noted above, IFRS 17 requires an entity to divide a portfolio of insurance contracts into a minimum of:

- If applicable, those contracts that are onerous at initial recognition

- Those contracts that at initial recognition have no significant possibility of becoming subsequently onerous, and

- The remaining contracts, if any.

Accordingly, the unit of account applied by an entity under IFRS 17 can be, depending on the circumstances, the portfolio level or somewhere between the portfolio level and the individual contract level.

Further disaggregation of insurance contract portfolios

Consistent with the International Accounting Standard Board’s (IASB) desire for insurers to provide useful information to users, IFRS 17 permits entities that issue insurance contracts to subdivide the three groups described above into further sub-groups, subject to the information they generate regarding the groups from their internal reporting systems:

- More groups that are not onerous at initial recognition that distinguishes:

- Different levels of profitability, and

- Different possibilities of contracts becoming onerous after initial recognition, and

- More than one group of contracts that are onerous at initial recognition based on the extent to which the contracts are onerous.

However, to avoid the prospect of ‘perpetually open’ portfolios, and the potential concomitant loss of information about the development (or deterioration) of the profitability of groups of insurance contracts over time, IFRS 17 prohibits entities from including contracts issued more than one year apart in the same group. The following provides a diagrammatical depiction of these disaggregation requirements and options.

It is also relevant to note that IFRS 17 does not permit groups of contracts established on initial recognition to be reassessed. Consequently, a portfolio of contracts that is determined to be onerous at initial recognition will continue to be accounted for separately for the life of the portfolio, even if some of the contracts subsequently become profitable.

Entities currently applying IFRS 4 are not subject to any unit of account requirements. In addition, as noted above, IFRS 4 provides entities with an exemption from the requirements in other IFRS, including paragraphs 10-12 of IAS 8. Accordingly, for some entities currently applying IFRS 4 the transition to the portfolio requirements in IFRS 17 could have significant impacts on the way they account for insurance contracts.

Next month

Next month we will look at how an entity would account for any non-insurance components contained within insurance contracts, as well as start looking at the measurement models under IFRS 17.

For more on the above, please contact your local BDO representative.

This publication has been carefully prepared, but is general commentary only. This publication is not legal or financial advice and should not be relied upon as such. The information in this publication is subject to change at any time and therefore we give no assurance or warranty that the information is current when read. The publication cannot be relied upon to cover any specific situation and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact the BDO member firms in New Zealand to discuss these matters in the context of your particular circumstances.

BDO New Zealand and each BDO member firm in New Zealand, their partners and/or directors, employees and agents do not give any warranty as to the accuracy, reliability or completeness of information contained in this article nor do they accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it, except in so far as any liability under statute cannot be excluded. Read full Disclaimer.