For 2020 reporting dates, impairment testing of an entity’s assets will come under the microscope.

The most obvious reason for this is the impact of COVID-19, which may now introduce indicators of impairment for entities whose cash inflows (i.e. top-line) are negatively impacted.

Where indicators of impairment exist, impairment tests must be carried out, requiring (in most cases) the compilation of discounted cash flow (DCF) models to determine an asset’s (or cash generating unit’s (CGUs)) recoverable amount.

In addition to COVID-19, for for-profit entities who apply NZ IFRS, there is a new asset balance that has now been thrown into the mix, being the Right of use Asset (RoU Asset) as a result of the new lease standard (NZ IFRS 16) - refer to our previous Cheat Sheets for further information.

In addition to throwing in a new asset balance to consider, NZ IFRS 16 also changes the nature of the cash flows related to leases (from operating cash flows that are incorporated in DCF models, to financing cash flows that are excluded).

Accordingly, NZ IFRS 16 will result in consequential changes to DCF models on two fronts:

- The make-up of the DCF model itself (i.e. new assets added in, changes in lease payment cash flow treatment, changes in the discount rate used (i.e. the weighted average cost of capital (WACC)), adjustments for lease cash flows after the period the RoU Asset covers etc.).

- Where leased premises generate their own independent cash inflows[1] (e.g. retail stores, on-leased premises), impairment testing conducted at this lower (more granular) level where indicators of impairment exist (i.e. additional and/or new DCF models may now be required).

Accordingly, these consequential impacts to impairment testing may potentially result in increased in time and cost for entities and their auditors as new and/or amended DCF models are required to be prepared.

This Cheat Sheet has been produced as a high-level overview of these issues, as well as a refresher of the general impairment requirements of NZ IFRS.

Need assistance with your adoption of NZ IFRS 16?

BDO IFRS Advisory is a dedicated service line available to assist entities in adopting NZ IFRS 16. Further details are provided on the following page for your information.

What is covered in the Cheat Sheet

In order to navigate through these areas of accounting, this Cheat Sheet is broken down into the following sections:

[1] Note, this is also the case for owned premises.

Requirements to perform impairment testing

Certain types of assets have specific or “built-in” impairment testing within their own accounting standards, such as:

- Debtors, loans receivable, other receivables, cash, other financial assets (NZ IFRS 9)

- Inventory (NZ IAS 2)

- Equity accounted investees – Associates and Joint Ventures (NZ IAS 28)

- Deferred tax assets (NZ IAS 12)

For most other types of non-current assets, impairment testing requirements are addressed by a separate accounting standard, NZ IAS 36 Impairment of assets, including assets such as:

- Goodwill

- Intangible assets

- Property, plant and equipment, and

- RoU assets (i.e. the new asset balances required to be recognised under NZ IFRS 16).

It is these impairment tests under NZ IAS 36 that this Cheat Sheet will focus on.

Timing of impairment tests under NZ IAS 36

An annual impairment test is mandatory for (i) Goodwill, (ii) Indefinite life intangibles (I.e. Brands etc.), and (iii) Intangibles still under construction (i.e. not yet available for use).

This is the case even if there is no indication of impairment.

If an indication of impairment arises between annual testing dates, an additional impairment test at that point in time must be performed.

Requirement to test in specific situations

All other assets within the scope of NZ IAS 36 are tested for impairment when there is an indication of impairment.

The impacts of COVID-19 will generally be considered an external indicator that impairment for most entities (refer to 5. below for further discussions on this).

At what “level” is impairment testing performed (i.e. what is the “unit of account”)?

Impairment testing is very much a “bottom-up” assessment, starting from an individual asset perspective.

This means that when an impairment test is carried out, an entity first looks at whether an asset can be impairment tested on its own.

If not, the asset is then grouped together with other assets (and/or allocations thereof) that represent the lowest level where cash inflows (top-line) can be generated largely independent of other assets (or groups of assets).

This grouping of assets is what NZ IAS 36 refers to as cash-generating-units (CGU’s)[1].

For those entities that have previously performed impairment testing for Goodwill and Brand assets etc. the concept of CGU’s will not be a foreign one.

However it is important to note that these previously identified CGU’s may not necessarily be the same CGU’s to be applied where other assets are now required to be impairment tested under NZ IAS 36 – i.e. as a result of COVID-19.

That is, for these other assets that may now need to be impairment tested under NZ IAS 36, their CGU’s may be more granular (i.e. lower to the “bottom”).

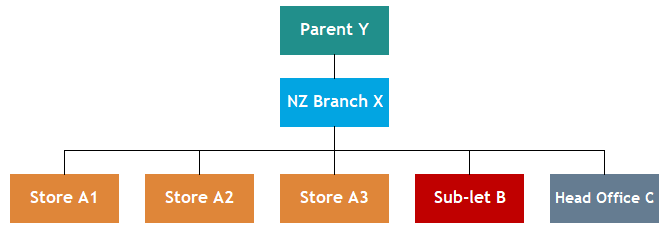

For example, consider the following entity A.

(a) Description of structure

“X” is the NZ branch of Global electronics retailer “Y”, and represents a separate operating segment[1].

X has the following buildings:

- 3 leased stores “A1, A2, A3”

- 1 surplus office building sub-let to a third party “B”

1 head office for HR, marketing etc. “C”

(b) Assets in play (“bottom up” analysis)

| Asset | How it is tested (allocated) for impairment | CGU |

| Inventory |

Not tested in a CGU under NZ IAS 36. Rather, measured at lower of cost, or net realisable value (NRV) per NZ IAS 2. |

- |

|

RoU Asset Stores A1, A2, A3 |

While the stores can generate cash inflows independently from each other, they cannot generate cash inflows on their own (i.e. without the use of other assets – see below). Accordingly, the RoU Asset of each store is assigned to a separate sub-CGUs. |

CGU A1 CGU A2 CGU A3 |

|

RoU Asset Sub-let B |

Because this building is being sub-let, it is able to generate cash inflows independent from all other assets (i.e. rental payments). Accordingly, the RoU Asset of the Sub-let office is tested on an individual basis. |

individual basis IB1 |

|

RoU Asset Head office C |

The Head Office does not generate any independent cash inflows, it is what NZ IAS 36 refers to as a “corporate asset”. As such, the carrying amount of the Head Office asset is allocated to the CGU(s) that its activities directly contribute to cash inflow generation. In X’s case, this is each of the individual stores. Accordingly, a portion of the carrying amount of the RoU Asset is allocated to each of the CGUs that the three stores are themselves allocated to. |

CGU A1 CGU A2 CGU A3 |

|

PP&E in building Leasehold improvements, equipment |

PP&E does not generate any independent cash inflows. PP&E that is in the stores will be directly attributed to those stores CGU’s. PP&E in the Head Office will be apportioned on the same basis as the RoU Asset above. |

CGU A1 CGU A2 CGU A3 |

| Goodwill |

In X’s specific case, goodwill is monitored internally only at the NZ Branch X level3. Accordingly, goodwill is allocated to NZ Branch X for impairment testing[1]. |

CGU X |

[1] Note, the identification of operating segments and CGUs is an entity-specific assessment, and as such, the above is used for illustrative purposes only. Accordingly, a different scenario could have alternatively have had operating segments and the level of goodwill monitoring at higher/lower levels of the business.

How does the impairment testing of CGUs play out in practice?

Carrying on from the previous example above…

In past financial years, when “times were good” such that there were no indicators of impairment across X’s asset base, entity X would have only been required to perform an impairment test at a CGU X level (i.e. as goodwill must be tested each year).

Entity X may not have even considered, or identified, the lower-level CGUs that may have existed underneath CGU X (i.e. CGU A1, CGU A2, CGU A3, and IB1).

So, when indicators of impairment now present themselves in the COVID-19 environment, this then “triggers” impairment tests now being required for these lower-level CGUs (i.e. CGU A1, CGU A2, CGU A3) and assets tested on an individual basis (i.e. IB1)

An obvious initial practicable consequence of this is that more impairment test models may now need to be executed – potentially requiring additional time and cost to an entity’s financial reporting (and external audit) processes for current and upcoming year ends.

Does COVID-19 result in indicators of impairment being present?

Remember, when considering impairment under NZ IAS 36 an entity is looking for facts and circumstances that have had (or have the potential to have) a detrimental impact to the cash INFLOWS (i.e. top-line) that are attributable to the asset(s) in question.

For many business that are not in the essential goods and services industries (and potentially, maybe even some that are) it is fairly apparent that the consequences of COVID-19 have either a specific or inherent detrimental impact to the ability to generate cash INFLOWS.

High-level examples of these include (but are not limited to):

- Loss of consumer demand (essential goods and services, versus “nice-to-haves” and luxuries)

- Loss of consumer purchasing/repayment power (rising unemployment, decreased business confidence etc.)

- Closure of markets (export markets, ceasing of specific industries etc.),

- Ability to operate (lockdowns, store closures, restrictions on trading practices etc.), and/or

- Ability to distribute (scarcity or prohibitive pricing of logistics and freight services etc.).

A key point to note is that this assessment of a detrimental cash inflow impact must be made broadly, for example:

- Considering not just what the status quo is now, but what may probably unfold in the future (i.e. a second wave of COVID-19, the re-opening and re-lockdown of domestic and international markets etc.).

- Looking at the impact beyond an entity’s own customers, to having to look at the entity’s customers’ own customers (i.e. an entity’s customers can only pay the entity, if their customers are paying them).

Whether COVID-19 has resulted in a detrimental cash inflow impact of such a quantum that it represents an indicator of impairment needs to be an entity-specific determination.

With that being said, it should be of no surprise that (for most entities) the consideration of whether these exist will need to be given sufficient scrutiny and analysis – noting that this will be a key area of concern and focus of external auditors.

In looking back at the previous example, the presence of any one of the examples (a) – (e) would likely give rise to indicators of impairment to the assets that exist at the store-level CGU’s (i.e. CGU A1, CGU A2, CGU A3, and IB1). – in particular, store closures during lockdown periods, as well as restrictions on trading post lockdown (key indicators for bricks-and-motor retail based business).

Accordingly, X would now be required to prepare three additional impairment test models for the store CGUs, as well as an impairment model for the on-leased office building.

Impairment testing - generally

Impairment exists when the carrying amount of an asset (CGU) is higher than its recoverable amount.

The recoverable amount can be determined one of two ways, and is the higher of the two:

i. Fair value less costs of disposal (FVLCD):

- Being a market-based measure assuming the value of the asset (CGU) will be recovered through sale.

- Recoverable amount represents a market sale price in an orderly market transaction.

ii. Value-in-use (VIU):

- Being an entity-specific measure assuming recovery of carrying amount from continuing use in the business.

- Recoverable amount represents the present value of future cash flows expected to be derived from the asset (CGU) – i.e. the use of discounted cash flow models (DCF).

The discount rate used in the DCF is typically the market weighted-cost-of-capital (WACC[1]) of the debt-to-equity structure of the assets (CGUs) being tested.

The remainder of this Cheat Sheet will highlight the application of VIU (as VIU is typically the most common method entities use for impairment testing CGUs that will still be used by the entity, rather than sold).[1] An entity’s are capital structure is typically comprise of a mixture of debt (financing) and equity (shareholder investment). Each of these have a cost (required rate of return) associated with them, and thus a weighted average rate of the two is required. Because shareholder investment is generally unsecured and subordinated to debt (i.e. more at risk), the required rate of return (i.e. cost of equity) is higher than that attached to debt.

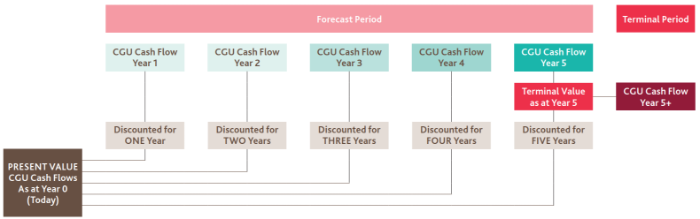

Discounted cash flow models- generally

The DCF is broken into two distinct periods:

- Forecast period, where cash flows for each year are specifically estimated (NZ IAS 36 limits this to 5 years), and

- Terminal period, the period beyond the forecast period where a terminal value of the specific cash flows in the last year of the forecast period is determined.

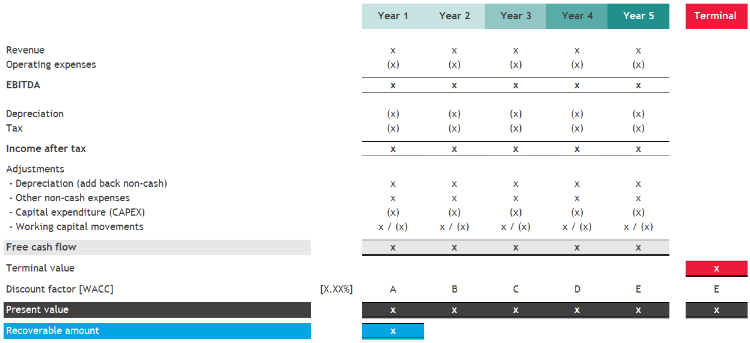

Estimating the individual years’ cash flow during the forecast period (and the terminal value) to be presented valued (by the WAAC) is typically done from top-down, free-cash-flow approach (typical example shown below):

Discounted cash flow models - adjustments required for COVID-19

The effects of COVID-19 will “touch” various inputs and assumptions in an entity’s DCF impairment models.

| Area of impact | Details |

|

Inflows Revenues and other income streams |

For most entities not involved in essential goods and services, COVID-19 will result in decreases in revenues over the short to medium term. The extent of this decrease, and timing of any future recovery, will need to be reflected in the DCF. It should also be noted that NZ IAS 36 prohibits entities from incorporating changes to cash inflows associated with future restructuring. |

|

Outflows Expenses and CAPEX |

Assumptions regarding operating and capital expenditures will need to be consistent with those for revenues (i.e. if revenues are decreasing, the expectation would be that expenditures would also be decreasing, however not necessarily but the same rate). It should also be noted that NZ IAS 36 prohibits entities from incorporating changes to cash outflows associated with future restructuring. |

|

Forecast period and Terminal period |

The terminal period is intended to estimate the present value of a stable net cash flow out into infinity. Accordingly, the period’s cash flow that this is based on is important - too low (high) and total present value of free cash flows used to support the carrying amount of the asset (CGU) will be under (over) stated, resulting in an incorrect impairment assessment Ordinarily, NZ IAS 36 prohibits the forecast period being greater than five years. However, longer periods can be used so long as both:

While an argument for (i) may be able to be made for certain entities, most entities will (and historically have) struggled to meet (ii). That being said, entities will still need to be cautious of the cash flows they are using to determine the terminal value. |

|

Long term growth rate Used in Terminal value determination |

The rate used to forecast cash flows in the terminal period (and then used in the rate to discount these cash flows back) is not allowed to exceed the relevant long-term average growth rate attributable to the entity, considering the associated products, industries, markets, and jurisdiction. For most entities not involved in essential goods and services, COVID-19 will result in decreases in these long-term growth rates. |

|

WACC – discount rate Change in the cost of equity |

The COVID-19 environment adds additional uncertainty and thus risk into the general economic environment. Accordingly, investors will demand a higher return on their unsecured equity investments. This increase in the cost of equity will increase the WACC and therefore decrease the discounted cash flows to support the carrying amounts of CGUs. |

|

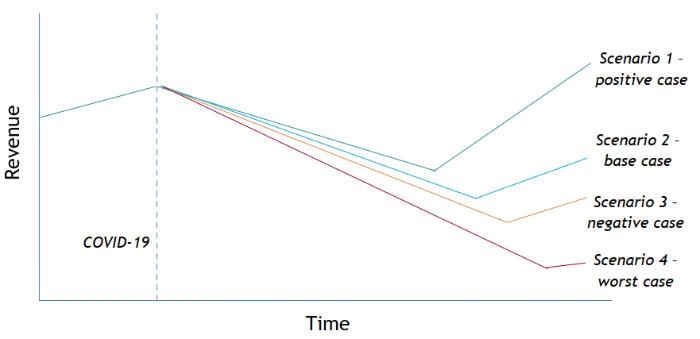

Number of scenarios to be run |

Prior to COVID-19, there was likely to be minimal variability in future cash flows to be projected, and/or the risks inherent in the cash flows could be appropriately captured in the discount rate used. In this case, entities may have previously used a single, best estimate cash flow projection in their DCF models. The uncertainty of COVID-19 challenges this previous status quo, bringing in variability around future cash flow quantum and timing (i.e. recovery). Given the high-level of uncertainty that COVID-19 creates, entities may be required to consider under compile multiple DCF scenarios, with each then being probability weighted to determine the “averaged” free cash flow to compare to the asset (CGU). |

Discounted cash flow models - adjustments required for RoU Assets

When CGU’s now include RoU Assets from the new lease accpunting, the impairment test model will need to be modified from those that may have previously existed prior to the application of NZ IFRS 16, for example:

| Area of impact | Details |

|

RoU Asset Include in the CGU’s asset group |

RoU Asset’s related to leases within the CGU now must be included in the carrying amount of the CGU’s assets to be tested for impairment. |

|

Lease liability Whether to include in the CGU’s asset group |

Because the Lease liability is considered debt (i.e. a financing activity) it is generally excluded from the CGU asset group. The only exception is where a purchaser of the CGU would assume the liability, which is not relevant to VIU impairment testing, as this is based on the assumption the assets will still be used by the entity (however this would be relevant for FVLCD impairment testing, where the assumption is based on sale rather than use). |

|

WACC – discount rate Change in debt to equity structure |

Because the Lease liability is considered debt, an entity’s debt-to-equity structure will change (i.e. more debt being present), and therefore, the WACC will likely change. All other things being equity, because the cost of debt is typically lower than the cost of equity, WACC rates should decrease (with more “weighting” being given to the lower cost of debt). However, note that WACC may increase as a result of an increase to the cost of equity from COVID-19 (refer above). |

|

Lease payments Are they in or out of the DCF? |

Because the Lease liability is considered debt, related lease payments are excluded from the DCF – i.e. compared to prior period DCF’s. As such, operating expenses will decrease, an over all free cash flows will increase. However, for periods beyond the lease period that covers the RoU Asset, the ongoing (estimated) lease payments beyond the current lease term still need to be incorporated into the DCF such as:

|

|

Depreciation of RoU Asset To be added back |

As with depreciation on property, plant and equipment, depreciation on RoU Assets must be added back in determining the free cash flows to discount. |

Instances that might erode previous headroom – from adjustments required for RoU Assets

While economically nothing has changed when entities adopt NZ IFRS 16 (i.e. it is just a change in accounting treatment), the adoption of NZ IFRS 16 can “mechanically” result in an immediate erosion of headroom - and consequentially, potentially give rise to impairment.

Differences between the WACC rate and the discount rate used under NZ IFRS 16

Prior to NZ IFRS 16, the lease payments were reflected in the DCF as operating expenses, and were therefore being discounted at the WACC rate.

Now, under NZ IFRS 16, these same lease payments are:

i. Removed from the DCF’s operating expense cash outflows (that are discount by WACC)

ii. Included in the determination of the RoU Asset recognised (that are discounted by the associated cost of additional debt[1]).

This results in both an increase to the discounted net cash flows, and the asset carrying amounts to be supported.

However, because the net cash flows are discounted at a higher rate (i.e. the WACC rate, which incorporates the higher costs attached to equity (refer section 6. above))), the increase in discounted cash flows is lower than the increase in assets to be supported by those discounted cash flows.

Example:

|

5yrs |

|

$10,000 per year |

|

14% |

|

8% |

| Increase in free cash flows: | $34,331 (PV of $10,000 over 5 years at 14%) |

| Increase in assets: | ($39,927) (PV of $10,000 over 5 years at 8%) |

| Shortfall: | ($ 5,596) |

ii. Method used to adopt NZ IFRS 16

If an entity has used the Modified Retrospective Method to adopt NZ IFRS 16, together with that added practical expedient to simply set the RoU Asset equal to the Lease liability at adoption date, then the RoU Asset will technically be artificially higher than it otherwise would be (refer to our previous Cheat Sheets for further information).

Adding to the asset base in this way will inherently erode into previous headroom, all other things being equal.

[1] The entity’s incremental borrowing rate (IBR).

Members of BDO’s IFRS Advisory department come ready with real life experience in applying IFRS and are therefore well placed to provide entities with the expertise and assistance they require.

For more information as to how BDO IFRS Advisory might assist with assessing the impact of your adoption to new accounting standards please contact James Lindsay at BDO IFRS Advisory and visit our IFRS Advisory webpage.