For year ends 31 December 2019 and onwards, the long awaited new accounting standard for leases (NZ IFRS 16) comes into effect.

In terms of day-to-day and transition accounting, NZ IFRS 16 is not an easy accounting standard to navigate. As such, entities whose next year-end is just around the corner, that have only just started planning for the adoption of NZ IFRS 16, may be feeling the “pinch”.

This Cheat Sheet has been produced as a high-level overview of how entities should be approaching the adoption of NZ IFRS 16.

Need Assistance with your adoption of NZ IFRS 16?

At the outset, it is widely known and accepted that NZ IFRS 16 will cause a fundamental change in the way that lessee’s must now account for their leases.

Resulting in (i) new balances, (ii) changes in the nature/quantum profit or loss line items, (iii) reshuffling of cash flow classification, (iv) changes financial metrics (EBIT, EBITDA, net profit, gearing etc.), and (v) other related consequential impacts.

Therefore, it should be of no surprise that getting the correct adoption to, and ongoing application of, NZ IFRS 16 is paramount.

The task of adopting NZ IFRS 16 is not as simple as “putting some numbers in a spreadsheet and running some formulas”. While practicably this is the end result (whether in a manual spreadsheet or with the use of dedicated lease accounting software) HOW you get to this “number-crunching” may require significant pre-work.

As we see it, there are 5 crucial, high-level key steps an entity should work through to ensure that their adoption of NZ IFRS 16 is (i) complete, (ii) accurate, (iii) robust, and (iv) well documented (crucial for Audited entities).

These steps are illustrated in the diagram below and expanded on throughout the remainder of this Cheat Sheet.

| Step 1 - Educate |

Knowledge is power, and understanding the features of NZ IFRS 16 is no different.

Working through the other subsequent steps on the “adoption journey” is fruitless unless you know what to expect and plan for.

With the benefit of hindsight, entities that have already adopted NZ IFRS 16 will tell you that upfront investment at this stage is (i) invaluable, (ii) should not be underestimated, and (iii) should not be discounted.

There exists a plethora of publically available guidance and learning material issued on this new accounting standard, including the following issued by BDO which entities are able to freely access with the links below.

Also, BDO IFRS Advisory specialises in providing dedicated and customised in-house training regarding NZ IFRS 16. If this is something you feel you or your team would benefit from please do not hesitate to get in touch to discuss your entity’s training needs and options we can provide.

| Step 2 - Inform |

The practical impacts of NZ IFRS 16 is NOT limited solely to the finance function of an entity. It is likely other stakeholders will need to be brought up to speed to various degrees for the purposes of (i) assisting in the finance team’s data collection, and (ii) assessing changes to stakeholder’s own go-forward, business-as-usual processes.

Below is a (non-exhaustive) list of stakeholders that may be impacted by NZ IFRS 16, and factors to consider:

|

Stakeholder |

Reason to inform |

Go-forward impact concerns |

|

Procurement teams |

Depending on how the financial impacts are “digested” by Senior Leadership, there may be changes in an entity’s “Lease vs. Buy” policy. |

Changes in on-going “Lease vs. Buy” decisions. |

| To the extent that these teams hold copies of lease agreements, these will need to be provided to the finance team. | Information requirements, both initially and on-going. | |

|

Property (and other asset) teams |

Depending on how the financial impacts are “digested” by Senior Leadership, there may be changes in an entity’s policy around negotiating lease terms. |

Changes in on-going lease negation practices. |

| To the extent that these teams hold copies of lease agreements, these will need to be provided to the finance team. | Information requirements, both initially and on-going. | |

| Treasury team | May be called upon to determine and provided incremental borrowing rates required to calculate lease liabilities. | Information requirements, both initially and on-going. |

|

Human resources (HR) Acquisition and mergers team Banks and other financers Legal experts |

An entity’s financial metrics will change on adopting NZ IFRS 16, especially EBIT, EBITDA, Net Profit, gearing etc.

This might consequentially impact:

|

These stakeholders will need to assess the exposure to, and then to manage the change of, these impacts.

This may require the revision of previously agreed contractual terms and conditions that do not incorporate mechanisms for addressing financial impacts of new accounting standards. An entity’s legal experts will need to be consulted where this looks as though it may be necessary. |

| Other group entities

Subsidiaries |

Where the entity prepares consolidated accounts, its Other group entities will all need to ensure that they adopt NZ IFRS 16 in EXACTLY the same way (i.e. transition and general options) at EXACTLY the same time (i.e. in-line with the entity’s year end). Also, as the individual entities are likely the holders of their lease agreements, these will need to be provided to the entity’s finance team. |

Developing their own NZ IFRS 16 adoption plan, or having a plan enforced upon them by the entity. Challenges may arise where year-ends and application of (NZ) IFRS 16 differs - especially those Other group entities that apply US GAAP. Information requirements, both initially and on-going. Where access to information may be limited (i.e. Associates) this will need to be addressed. |

|

Senior Leadership Shareholders |

Senior Leadership will need regular, detailed and concise information regarding all of the above, so that informed decisions can be made regarding the implementation of, and ongoing consequential impacts from, the adoption of NZ IFRS 16. Depending on the size and scale, certain entities may establish a project “Steering Committee”, made up representatives from various stakeholder groups and external experts. BDO IFRS Advisory has experience in sitting on such “Steering Committees”. If this is something you feel your entity would benefit from please do not hesitate to get in touch to discuss your entity’s needs and options we can provide. |

|

| Step 3 - Loop in |

For entities with external Auditors, “looping” them into your adoption journey is essential.

This ensures that the work to be done by, and documented output from the entity will provide a sufficient audit trail. Too often we have seen entities head out with the best of intentions, only to find that there is some analysis, sourcing of inputs, and/or calculation the entity may have not executed correctly (or at all) that the auditors require.

For this reason, “looping” the auditors in early, and getting them to “buy-in” to being part of journey makes the journey focused and accurate, and mitigates the potential for disappoint and rework at the final hurdle, when time is tight. For that reason, entities should be empowered to take a proactive step in this regard.

We would recommend that an entity action this “loop-in” of the auditors by an entity occura both (i) before setting off on developing its Adoption Plan, and then (ii) before finalising its Adoption Plan.

| Step 4 - Develop the Adoption Plan |

Anyone who has had experience in project management will tell you “diving in head first” without a plan is only going to lead to pain and agony both come the end of the journey, and almost certainly along the way.

Also, no project ever goes 100% to plan, there are always the 5% of “unknowns” you discover along the way. But to the extent you have solid foundation of what is happening for the other 95% you can plan ahead for, you set yourself up for success.

An entity’s adoption of NZ IFRS 16 is no different. It is interesting to note that for many entities who have already adopted NZ IFRS 16, with the benefit of hindsight, this is one area they wish they has done more thoroughly (or in some cases, at all).

One primary reason is that having such a plan will immediately highlight whether an entity may require additional resource and expertise, which itself may require the approval of Senior Leadership in advance.

For this reason, and for audit evidence and documentation purposes, this plan should be (i) formally documented, (ii) approved by the appropriate person or body.

Each entity’s Adoption Plan needs to be specific to the nature of its organisational structure (i.e. Other group entities) and the nature and extent of the total lease population.

However, high-level areas that the Adoption Plan should address and cover would likely include:

|

1. Identify the lease population

|

2. Determine which options to use (i) General application options and expedients:

(ii) Adoption application options and expedients:

|

|

3. Identify application areas

(i) Different year ends, (ii) Different application of General and Adoption options, (iii) US GAAP etc.

|

4. Begin compiling data and documents

Both for (i) adoption, and (ii) on-going (new leases).

|

|

5. Determine who will “number-crunch”

|

6. Set timelines and tactics Look to stablish a project GNATT chart, so that:

|

|

7. Loop-in the entity’s Auditor prior to finalising As mentioned above, getting input from the entity’s Auditor on the proposed Adoption Plan BEFORE it is finalised and ultimately executed will ensure that everyone is on the same page as to (i) what is involved, and (ii) what will be produced at the end. This is a crucial step in ensuring that expectation gaps between the entity and the Auditor are mitigated so that minimal (if any) additional (re)work does not need to be undertaken at the back-end of the journey. |

As noted above, it cannot be stressed strongly enough the importance of having a clear and documented Adoption Plan.

BDO IFRS Advisory has real-life experience devising, reviewing, and implementing these Adoption Plans. If this is something you feel you or your team would benefit from please do not hesitate to get in touch to discuss your entity’s needs and options we can provide.

| Step 5 - Execute |

Once the Adoption Plan has been finalised, approved, and communicated, it is time to get stuck in!

(i) Ensure you (i.e. the Finance team) keep “in the know”

In the initial days/weeks, and at various key stages, it may be necessary to have regular meetings with those people directly responsible for various aspects of the Adoption Plan, to ensure progress is moving along as planned.

This is why a detailed GNAT chart (refer box (6) above) is crucial.

(ii) Ensure you keep the entity’s auditor “in the know”

At various stages of the Execute phase, an entity may see benefit in looping the auditor back in to ensure that there is consensus in the decisions and/or calculations the entity is making – to mitigate potential back-end (re)work.

Below is a list of common examples we have seen in practice which centres around having the auditor undertake their audit of the compiled lease data BEFORE an entity starts crunching any numbers, including (but not limited to):

- The application of general and adoption options.

- The nature and treatment of, for example:

- Variable lease payment mechanisms.

- Lease incentives offered.

- Lease renewal, termination, extension, and purchase options.

- Subleases.

- The entity’s policy regarding, and ultimate determination of, incremental borrowing rates to be used.

- Review of a sample of the entity’s first attempts of the “number crunching” (i.e. to confirm the entity’s approach/template can be rolled out to its wider lease population in full).

(iii) Ensure you keep the Senior Leadership in the know

Where the entity has elected to implement a project Steering Committee, the expectation is that they will be feeding relevant information, findings, and impacts through to the relevant Boards and Committees they each sit on.

Where an entity has not elected to implement a project Steering Committee, consideration will have to be given as to how often, and in what forum, relevant information, findings, and impacts will be communicated through to Senior Leadership and any other impacted Boards and Committees.

BDO IFRS Advisory – Tailored Transition Assistance

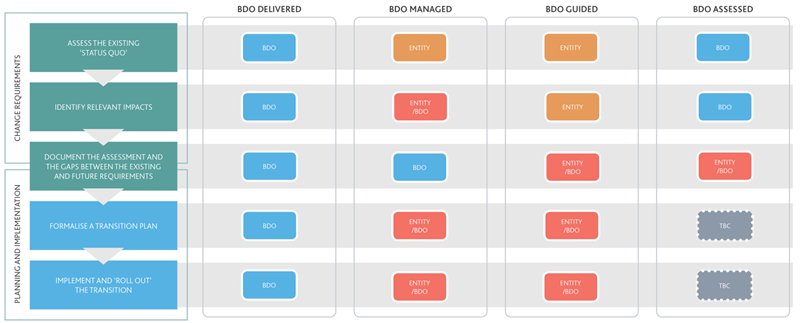

BDO adopts a flexible and fully customisable approach to assisting entities with their transition to new accounting standards. This allows us to be as involved as an entity requires, so that this can be built around an entity’s own existing in-house resourcing and expertise.

Often entities have an idea of what needs to be done, but don’t know exactly where to start or focus their energies, and just want to get the ball rolling.

We have found our BDO Guided and BDO Assessed approaches fit well to accommodate this, whilst also retaining the ability to scale up involvement quickly if need be – either way, we work WITH you.

Members of BDO’s IFRS Advisory department are well placed to provide expertise in the adoption of NZ IFRS 16. They have real-world experience on “both sides of the fence”, both in (i) developing and executing Adoption Plans, and (ii) assessing and analysing the output of an entity’s adoption.

For more information as to how BDO IFRS Advisory might assist with assessing the impact of your transition to new accounting standards please contact James Lindsay or visit our IFRS Advisory page.