IRD have been scrutinising what farmers claim in relation to farmhouse expenses and have given new guidelines to what they consider acceptable.

These changes will be in place from the start of the taxpayer’s 2017/18 tax year, and so for many farmers this will apply from 1 June 2017 for Dairy and from 1 July 2017 for Sheep and Beef depending on your balance date – so it’s worth thinking about now.

It has been common practice for farmers to claim 25% of many farmhouse expenses and 100% of others. This will now change and for the majority of farms the 25% will fall to 20%, but before that there is a first hurdle that needs to be jumped.

IRD are splitting farms into two types:

- Type 1 farms – where the value of the farmhouse is 20% or less of the total value of the farm

- Type 2 farms – where the value of the farmhouse is more than 20% of the total value of the farm

It will be critical to establish your farm type first, because for Type 2 farms the rule changes will mean that IRD will not accept an automatic claim of 20% and, instead, more work will need to be done to calculate the percentage claimable.

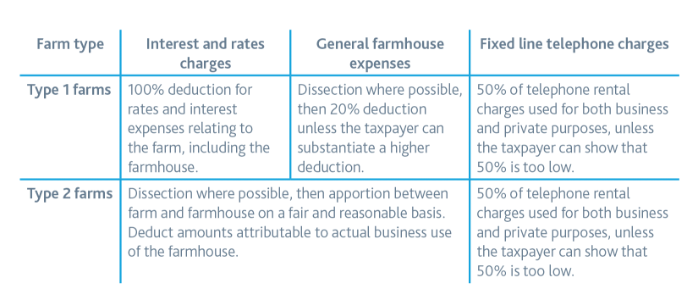

The following table helps summarise what is allowable under Type 1 and Type 2 farms:

Where the above table refers to dissection, that means that if an expense is directly attributable 100% to business or private then it is treated in that manner for tax. Where the expense has both a business and a private use (for example house power or insurance), then the apportionment rules in the table must be followed.

For those of you who complete your own GST records please bear this in mind – you may need to make changes ready for your next GST return.

If you are already in the 2018 financial year and have filed a GST return under the old rules, don’t worry, we will fix that up for you when we do the annual accounts.

Please note that if you are unsure of what farm type you fall into, please contact your local BDO adviser.