Convertible notes - Are you accounting for these correctly (Part 6)?

In the current economic climate, we continue to see different types of convertible note arrangements, typically entered into by companies needing to offer attractive returns in order to obtain funds from lenders and investors.

Over the past few months we have been looking at some practical aspects regarding accounting for convertible notes, including:

- An overview of the requirements (in the April 2018 edition of Accounting Alert)

- A detailed example of a convertible note classified as a compound financial instrument (in the May 2018 edition of Accounting Alert)

- A detailed example of a convertible note with an embedded derivative liability (in the mid-June edition of Accounting Alert)

- Common scenarios encountered in practice where conversion features either meet or fail equity classification (in the July 2018 edition of Accounting Alert)

- A detailed example of a convertible note converting into a variable number of shares based on the issuer’s share price at conversion date (in the August 2018 edition of Accounting Alert).

As noted in these previous articles, in order for a conversion feature to be classified as equity, the fixed for fixed test in IAS 32 Financial Instruments: Presentation (“IAS 32”) must be met (i.e. at initial recognition, the conversion feature gives the holder of the convertible note the right to convert into a fixed number of equity securities of the issuer).

|

This month we look at a detailed example where a convertible note is issued in a currency other than the issuer’s functional currency. |

Summary

It is common for international companies to raise funds via convertible notes issued in a currency other than their functional currency. Although the issue and repayment amount in foreign currency may be fixed, when converted back to the entity’s functional currency it results in a variable amount of cash (that is, a variable carrying amount for the financial liability that arises from changes in exchange rates), and therefore fails the fixed-for-fixed criterion for equity classification.

The conversion feature is therefore a derivative liability, with the value of the conversion feature being dependent on foreign exchange rates.

Example: Convertible note issued in a currency other than the entity’s functional currency

Global Co has an Australian dollar (AUD) functional currency but is raising funds in the United Stated and issues a USD500,000 convertible note.

The note has a maturity of three years from its date of issue and pays a 10% annual coupon in USD.

On maturity, the holder has an option either to receive a cash payment of USD500,000 or 500,000 of Global Co’s shares.

Assume that the derivative liability has a fair value of AUD10,000 at the time of issue.

Assume also that the exchange rate is USD1.00: AUD1.10.

Analysis

Step one

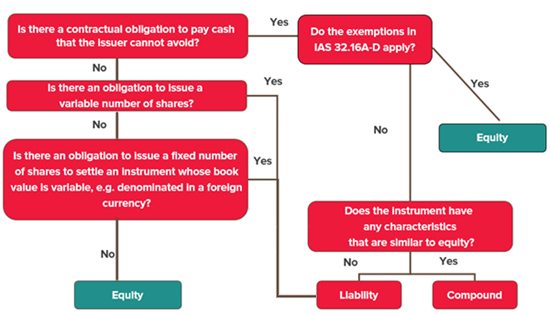

Starting with the box on the top left hand side of the flowchart above, we consider whether there is a contractual obligation to pay cash that the issuer cannot avoid. The answer is yes, because Global Co must pay the annual cash coupon and it could also be required to repay the capital amount at the end of three years if the holder chooses not to exercise the conversion option.

Step two

Step two is to consider whether paragraphs 16A-16D of IAS 32 apply. When an issuer has an obligation to repurchase financial instruments, in certain circumstances paragraphs 16A to 16D of IAS 32 include exceptions to the usual principles for classifying financial instruments as financial liabilities. In some cases, such instruments could be classified as equity, despite having an unavoidable obligation to pay out cash. However, this exception does not typically apply to convertible instruments and is not applicable in this example.

Step three

Continuing down the right hand side of the above flow chart, we then consider whether the instrument has any characteristics that are similar to equity. The answer is yes, because the instrument contains an option to be converted into equity instruments, but the question of whether the conversion feature meets the criteria to be classified as equity is dealt with separately in Step four below.

The host debt component will be classified as a financial liability because Global Co has an unavoidable obligation to pay cash, and on a standalone basis there is no feature in the host debt contract that is similar to equity.

Step four

The conversion feature is then assessed on a standalone basis using the above flowchart. Starting with the box at the top left hand side of the diagram:

- There is no contractual obligation to pay cash that the issuer cannot avoid. The equity conversion feature can only be settled through the issue of equity shares, otherwise it will simply expire unexercised.

- However, there is an obligation to issue a fixed number of shares to settle a liability that is variable (i.e. the amount of liability to be settled depends on the foreign exchange rate at the date of settlement).

The conversion feature also meets the definition of a derivative because:

- The variable amount to be settled varies in response to the foreign exchange rate

- It requires little or no investment upfront, and

- It is to be settled at a future date.

The conversion feature is therefore classified as a derivative liability.

|

This means that the note as a whole contains the following components:

|

Initial recognition

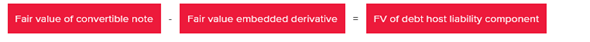

For convertible notes with embedded derivative liabilities, the embedded derivative liability is determined first and the residual value is assigned to the debt host liability.

On initial recognition, Global Co receives AUD550,000 (functional currency) at a rate of USD1.00: AUD1.10. Since it has been determined that the FX derivative liability has a fair value of AUD10,000, the carrying amount of the debt host liability on initial recognition by Global Co is AUD540,000. The journal entry recognised by Global Co, in AUD functional currency, on initial recognition is as follows:

Subsequent measurement

At the end of subsequent reporting periods during which the convertible note remains outstanding:

- The FX derivative liability is measured at fair value with changes recognised in profit or loss

- The host debt liability will be translated at the exchange rate at reporting date (paragraphs 23 and 28 of IAS 21 The Effects of Changes in Foreign Exchange Rates), with differences recognised in profit or loss, and

- Interest expense, calculated on an effective interest rate basis, is translated at the average exchange rate for the period.

For more on the above, please contact your local BDO representative.