COVID-19 impacts on the accounting for financial instruments under IFRS 9 and contract assets under IFRS 15

For periods ending 31 January 2020 onwards (which is the date that international governments started to take action in relation to the COVID-19 pandemic, such as implementing travel bans), the effects of COVID-19 will need to be incorporated when preparing financial statements.

There are many financial statement areas that will be impacted. This article discusses the complexities for financial instruments recognised under IFRS 9 Financial Instruments, as well as the expected credit loss impacts for contract assets recognised under IFRS 15 Revenue from Contracts with Customers.

In this article we discuss four potential impacts of COVID-19 on the accounting for financial instruments:- Increases in expected credit losses (ECL)

- Modifications to financial assets and financial liabilities (e.g. deferral of payment terms)

- Losses incurred on financial guarantee contracts

- Decrease in hedge effectiveness or disqualification from continuance of hedge accounting due to forecast transactions no longer being highly probable.

Increases in expected credit losses (ECL)

The expected credit loss (ECL) model in IFRS 9 is used to determine whether financial assets measured at amortised cost (such as trade receivables and loan receivables), debt instruments at fair value through other comprehensive income (FVTOCI) and contract assets recognised under IFRS 15, are impaired.

Under the ECL model in IFRS 9, an entity is required to provide for:

- 12-months of ECL, or

- Lifetime ECL if there has been a significant increase in credit risk (SICR).

The 12-month ECL is calculated as the risk of default over next 12 months, multiplied by the amount of ECL if there is a default.

Lifetime ECL is calculated as the risk of default over the life of the instrument multiplied by the amount of ECL if there is a default.

COVID-19 impacts across a wide variety of businesses and industries may result in higher ECL expenses due to an increase in:

- The risk of default, and

- The amount of ECL if a default occurs.

ECL is:

- A probability-weighted amount determined by evaluating a range of possible outcomes, and

- Discounted to reflect the time value of money.

As all financial assets subject to ECL require the risk of default to be estimated over the next 12 months, the effects of uncertainty relating to COVID-19 may be very significant. Additionally, the effects of COVID-19 may trigger a SICR, and therefore the recognition of a lifetime ECL provision on many financial assets.

Not all businesses will be impacted by COVID-19 to the same degree. For example, airlines and tour operators, as well as businesses that are subject to mandatory or voluntary shutdown as a result of ‘social distancing’ rules will be impacted to a greater degree than say the major supermarkets or entities manufacturing face masks or protective medical equipment.

It is therefore important for an entity to ‘know your customer’ when assessing ECL for 31 March or 30 June 2020 financial statements.

IFRS 9 is principles-based, and does not set any ‘bright line’ rules as to when ECL should be recognised, and how much should be recognised. Mechanical models used in prior reporting periods cannot simply be rolled forward without amendment. Given the unprecedented impact that COVID-19 is having on businesses around the world, ECL models may need to be completely reworked for the COVID-19 world we are now living in, or if this is not possible, entities will need to use historical models, but ‘overlay’ the latest macro-economic data to determine ECL. The impacts of any government stimulus or interventions must also be factored into ECL models as these actions could, in some cases, mitigate estimates of the risk of default and the amount of ECL.

Disclosures about estimates and judgements

As the COVID-19 impacts are rapidly evolving, entities will need to ensure that ECL calculations reflect the most up-to-date information available (without undue cost or effort) at reporting date. Given the inherent level of uncertainty about the future (how long will this situation go on for?), it is essential that entities provide sufficient, tailored disclosures about the key assumptions used.

While quantification of inputs used in ECL models, and information about sensitivities, is not strictly required by IFRS 7 Financial Instruments: Disclosure, paragraph 35G, we recommend that disclosures be as transparent as possible and include such quantification. For example: ‘If shutdowns last for 3 months, we expect ECL to be $xx but if they last 6 months, we expect ECL to be $yy’. (Note, there are RDR disclosure exemptions available)

Trade receivables and contract assets (simplified approach)

Where the ‘simplified approach’ is used, the ECL allowance is measured as the ‘lifetime’ ECL. This is because these items are usually short-term in nature, and therefore ‘lifetime’ ECL is essentially the same as the 12-month ECL for these balances.

Whether the ECL allowance should increase in March or June 2020 financial statements depends on individual customers’ facts and circumstances, as well as the expected end-point for COVID-19 impacts.

Example 1

Advertising Co sells its advertising services to major supermarkets and to entities in the tourism and travel industry.

Supermarkets have significantly increased their advertising spend during the COVID-19 crisis to deal with unprecedented demand due to stockpiling of toilet paper and groceries. On the other hand, international travel businesses have reduced or completely cut spending until travel bans are lifted. It is expected that this spend will resume once international tourism recommences, but this is only likely once a vaccination has been approved for use in humans.

After assessing historical and forward-looking information (including the impact of COVID-19), the following table summarises one possible set of outcomes for Advertising Co when assessing ECL:

| Customer | Expected impact on risk of default | Amount of expected credit loss | Overall impact on ECL |

| Supermarkets | Decrease or neutral | Decrease or neutral | Decrease or neutral |

| Travel | Increase | Increase | Increase |

Third party and intercompany loans receivables (3-stage ECL model)

When applying the 3-stage ECL model to long-term loans, these generally start out in Stage 1 (with ECL based on 12-month ECL) and move to Stage 2 when there is a SICR (with ECL based on lifetime ECL).

Government intervention in some countries has resulted in lenders being unable to take action to recover debts for a specified period, and in others, lenders have modified or rescheduled payments due from borrowers whose businesses are in ‘hibernation’, or experiencing difficulties making repayments because of COVID-19 flow-on effects from their own customers.

While modifications or rescheduling of repayments might ordinarily indicate a SICR, lenders should not assume that the impact of COVID-19 will result in a SICR across the board. This is because deferral of repayments may not result in a SICR. For example, regulatory action may be driving moratoriums on loan repayments, or banks and other lenders could voluntarily be extending payments given temporary difficulties being experienced by borrowers to make scheduled repayments.However, because the determination of ECL considers the amount and timing of payment, a credit loss will arise in instances where there is a delay in the payment of the contractually required amount, even if all contractual cash payments are ultimately expected to be received in full. In addition, because ECL is a probability-weighted amount determined by evaluating a range of possible outcomes, the heightened uncertainty may result in a higher probability being assigned to downside scenarios.

Example 2

Diversified Co provides loan funding to its four subsidiaries as indicated in the table below.

| Subsidiary | COVID-19 impacts on business model and ability to make loan repayments | SICR (Yes/No) | Expected impact on the risk of default | Amount of expected credit loss | Overall impact on ECL |

| Supermarket Co |

Little impact. Still able to make scheduled loan repayments. |

No | Decrease or neutral | Decrease or neutral | Decrease or neutral |

| Retail Clothing Co |

Some impact. Online sales have been increasing but sales from physical stores has reduced due to effects of the Level-4 lockdown and ongoing ‘social distancing’ rules being difficult to implement. Overall revenue has dropped by 20%. Retail Clothing Co is paying only 80% of each scheduled repayment and the remaining 20% has been rescheduled for repayment in 12 months’ time. The business is usually profitable. |

Judgement is required. As the business is usually profitable, the impacts of COVID-19 are likely to be temporary and therefore no SICR. |

Requires judgement |

May increase due to the timing of the payments being delayed and higher uncertainty. |

May increase |

| Travel Co #1 |

Revenue has reduced by 95%. Travel Co is unable to make any scheduled repayments until 6 months after global travel bans are lifted. The business is usually highly profitable. |

As for Retail Clothing Co above, judgement is required. As the business is usually highly profitable, the impacts of COVID-19 are likely to be temporary and therefore no SICR. |

Requires judgement |

May increase due to the timing of the payments being delayed, and higher uncertainty. |

May increase |

| Travel Co #2 |

Revenue has reduced by 95%. Travel Co is unable to make any scheduled repayments until 18 months after global travel bans are lifted. The business is loss making. |

Increase, but not necessarily as a result of COVID-19 because the business is loss-making and may be unable to make scheduled repayments, even in the absence of COVID-19. | Increase | Increase | Increase |

Modifications to financial assets and financial liabilities (e.g. deferral of payment terms)

Another consequence of the COVID-19 pandemic is that lenders and borrowers may enter into agreements to modify the terms of financial instruments such as bank loans. These modifications may take the form of reduced interest rates, modification to payment terms and ‘grace periods’ for covenant violations. Entities should consider the requirements of IFRS 9 for the modification of assets (for lenders) and liabilities (for borrowers). These modifications will generally give rise to gains for borrowers and losses for lenders.

Accounting by the borrower

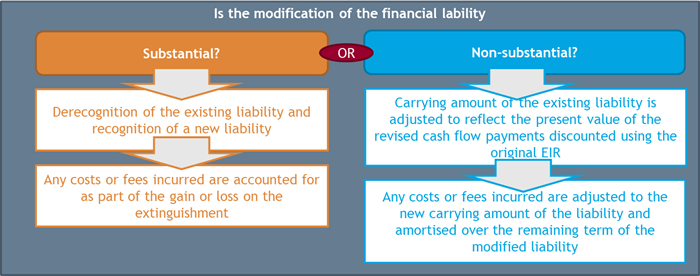

Where the terms of a financial liability of a borrower have been modified, the accounting treatment differs depending on whether the modification is considered ‘substantial’ or ‘non-substantial’. This is illustrated on the diagram below.

However, in our view, in addition to the 10% test, qualitative factors should also be considered to determine whether the loan modification is substantial. That is, even if the difference is less than 10%, the modification might still be considered to be substantial if there has been (for example):

• A change in currency of the loan

• A change from floating interest rates to fixed interest rates or vice versa

• A significant change in covenants, or

• The introduction or removal of an equity conversion feature.

If the difference in the present value of cash flows is more than 10%, that factor by itself is considered conclusive of a substantial modification.

If the modification is non-substantial, an entity is required to account for the difference between the revised cash flows under the new terms, discounted at the original EIR, and the existing carrying amount, in profit or loss. This adjustment is commonly referred to as a ‘catch-up’ adjustment.

If the modification is substantial an entity would account for the modification as an extinguishment of the existing financial liability and the recognition of a new financial liability.

Accounting by the lender

For lenders, IFRS 9 sets out guidance on the accounting for modification of financial assets where the modification does not result in derecognition (i.e. they are non-substantial). However, IFRS 9 does not contain any explicit guidance on determining whether a modification to the contractual cash flows of an asset results in derecognition (i.e. is substantial).

In an agenda decision of the IFRS Interpretations Committee from September 2012 it was noted that, in the absence of explicit guidance for the derecognition of a financial asset arising from a modification, an analogy could be made to the guidance for the modification of financial liabilities under which a substantial change in terms results in derecognition of the existing financial liability and the recognition of a new one. However, there is no requirement to apply this threshold by analogy and entities should also give consideration to the qualitative factors that leads to the modification, meaning that judgement may need to be applied.Derecognition is more likely to be considered appropriate when there is a change in currency or when moving from a fixed to a floating interest rate.

Losses incurred on financial guarantee contracts

Another area where COVID-19 is likely to have an impact is on the measurement of financial guarantee contracts recognised under IFRS 9. IFRS 9, paragraph 4.2.1(c) requires that financial guarantee contracts are recognised and measured by the guarantor at the higher of:

- The amount of the ECL under the 3-stage approach, and

- The amount initially recognised, less, any cumulative amount of income recognised in accordance with IFRS 15.

Under normal circumstance, where the risk of the debtor defaulting is reasonably low, financial guarantee contracts would be recognised as the amount initially recognised, less any cumulative amount of income recognised under IFRS 15 (i.e. the higher amount).

However, we expect that COVID-19 will increase the risk of the debtor defaulting in many instances. When considering SICR, an entity considers the changes in the risk that the debtor will default on the guaranteed loan. If the financial asset is fully guaranteed, the estimated cash shortfalls for a financial guarantee contract would be the same as the estimated cash shortfalls of the guaranteed financial asset, which means that the ECL amount under the 3-stage approach becomes ‘the higher amount’ as per IFRS 9, paragraph 4.2.1(c) above.

Guarantors will need to pay particular attention to the heightened risk of default when determining the ECL as described above.

Hedging impacts – Cash flow hedges of forecast future cash flows

IFRS 9, paragraph 6.4.1(a) only permits hedge accounting for eligible ‘hedged items’. Cash flow hedge accounting is typically used if the hedged item is a forecast transaction, which must be highly probable.

If due to COVID-19 impacts, forecast transactions are no longer highly probable, they do not qualify as an eligible hedged item and hedge accounting must be discontinued, with the balance on the cash flow hedge reserve treated as follows:

- If the hedged future cash flows are still expected to occur (even though they may not be highly probable), the balance on the cash flow hedge reserve remains in the cash flow hedge reserve until the future cash flows occur, and is then derecognised in the same way as for qualifying hedged item, or

- If the hedged future cash flows are no longer expected to occur, the balance on the cash flow hedge reserve is immediately reclassified to profit or loss as a reclassification adjustment.

Hedging impacts – Decrease in hedge effectiveness

The fair value of the derivatives designated as hedging instruments maybe impacted by the increase in market volatility of credit spreads, currency basis spreads and liquidity adjustments. These factors do not generally affect the hedged item. Consequently, there may be increase in additional profit or loss volatility as a result of decrease in hedge effectiveness.

For more on the above, please contact your local BDO representative.