Determining a lessee’s incremental borrowing rate – Dispelling the myths

IFRS 16 Leases requires the lessee to measure its lease liability at commencement date by discounting future lease payments using the interest rate implicit in the lease. However, if that rate cannot be readily determined, the lessee must use its incremental borrowing rate.

At the commencement date, a lessee shall measure the lease liability at the present value of the lease payments that are not paid at that date. The lease payments shall be discounted using the interest rate implicit in the lease, if that rate can be readily determined. If that rate cannot be readily determined, the lessee shall use the lessee’s incremental borrowing rate. IFRS 16, paragraph 26We expect in practice that many lessees will use the incremental borrowing rate (IBR).

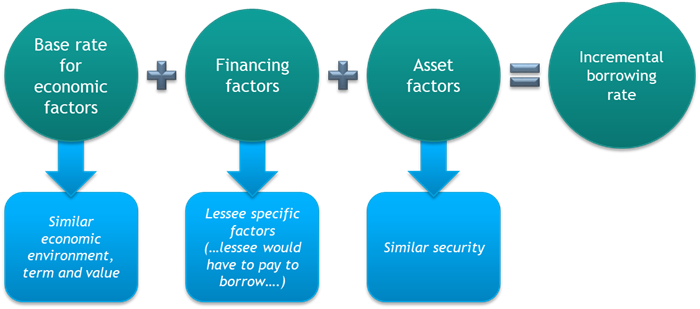

The rate of interest that a lessee would have to pay to borrow over a similar term, and with a similar security, the funds necessary to obtain an asset of a similar value to the right-of-use asset in a similar economic environment. Definition of ‘lessee’s incremental borrowing rate’ – IFRS 16, Appendix AThis article dispels some of the common myths regarding the IBR, what it is, and what it isn’t.

Myth 1: The IBR is the interest rate that an entity pays on its other debts

The IBR is not the interest rate that an entity pays on other debts (e.g. bank loans, revolving credit facilities, etc.). These rates may be an input into measuring the IBR for a lease, or may be appropriate solely on the basis of materiality; however, they would not typically have a similar term, security and other economic characteristics as the underlying lease.

Myth 2: An entity can use the same IBR for all of its leases

An entity cannot use the same IBR on all of its leases. This is because the level at which IFRS 16 applies to leases (i.e. the unit of account) is the individual lease, therefore, a discount rate is not determined for an entity as a whole, but for each individual lease.

Myth 3 - There are no practical expedients in IFRS 16 to simplify the process for determining IBR’s for each individual lease

Paragraph B1 of IFRS 16 allows an entity to apply IFRS 16 to portfolios of leases with similar characteristics if the entity reasonably expects that the effects on the financial statements of applying this portfolio approach would not differ materially from applying IFRS 16 to the individual leases within that portfolio.

The following table provides some examples where portfolios of leases may or may not be considered to have similar characteristics.

| Portfolio | Description | Similar characteristics such that practical expedient in B61 can be used? |

| Portfolio A | Consists of real estate leases in Country Z with lease terms of between 3-5 years |

Yes. Similar underlying assets (real estate). Similar terms (3-5 years). |

| Portfolio B | Consists of real estate leases in Country X with lease terms of between 7-10 years |

Yes. Similar underlying assets (real estate). Similar region (Country X) Similar terms (7-10 years). |

| Portfolio C | Portfolio consists of long-term real estate, equipment, motor vehicle and land leases, with lease terms ranging from 2-25 years with lease payments totalling many times materiality |

No. Different underlying assets (real estate, equipment, motor vehicle and land leases). Wide ranging lease terms (2-25 years). |

| Portfolio D | Portfolio consists of heavy equipment leases in 5 different jurisdictions with lease terms ranging 3-5 years, as well as a sub portfolio of real estate leases with lease terms ranging from 10-40 years with lease payments totalling many times materiality |

No. Heavy equipment is in 5 different jurisdictions. Real estate leases have wide ranging lease terms (10-40 years). |

| Portfolio E | Portfolio consists of three sub portfolios for a global conglomerate entity with leases entered into by its subsidiaries, segmented by class of underlying asset and lease term, with the IBR determined for the group as a whole and applied to all subsidiaries in all geographic locations, including their individual IFRS-compliant financial statements |

No. Although the group has segmented leases by class of underlying asset and lease term, each subsidiary is in a different geographic location (i.e. the IBR of the corporate parent is not necessarily the ‘the rate of interest that a lessee would have to pay’ in that geographic location). |

How should an entity estimate its IBR for a new lease or portfolio similar of leases?

Once the unit of account for leases (or portfolios of similar leases) has been determined, the IBR must be estimated. There are several ways in which this may be achieved in practice.

A common approach is to determine a ‘base rate’ (or ‘reference rate’) based on readily observable interest rates for public or liquid corporate debt and adjust that rate for relevant factors. A graphical illustration of this approach, and how it is consistent with the definition of the IBR, can be presented as:

More information

In next month’s Accounting Alert, we will follow with more examples to illustrate how to estimate the IBR.

For more on the above, please contact your local BDO representative.