Recognising revenue under IFRS 15

In the Mid-June 2018 edition of Accounting Alert we discussed the five-step model for revenue recognition introduced by IFRS 15 Revenue from Contracts with Customers:

| Step 1 | Identify the contract(s) with the customer |

| Step 2 | Identify the performance obligations in the contract |

| Step 3 | Determine the transaction price |

| Step 4 | Allocate the transaction price to the performance obligations |

| Step 5 | Recognise revenue when a performance obligation is satisfied |

Since then we have included a number of articles on IFRS 15 in Accounting Alert that cover various issues from the five-step process in greater depth:

| Step | Accounting Alert edition… | |

| Step 1 | Identify the contract(s) with the customer | June 2018 |

| Step 2 | Identify the performance obligations in the contract | July 2018 and September 2018 |

| Step 3 | Determine the transaction price | November 2018, February 2019, March 2019 and June 2019 |

| Step 4 | Allocate the transaction price to the performance obligations | March 2019 and July 2019 |

In this edition, we start our examination of the final step in the five-step process – recognising revenue when a performance obligation is satisfied.

Recognising revenue

Under IFRS 15, revenue is recognised when (or as) a performance obligation is satisfied by transferring a promised good or service (i.e. an asset) to a customer. Transfer occurs when, or as, the customer obtains control of the good or service.

‘Control’ of the good or service (asset) is the ability of an entity to:

- Direct the use of the asset

- Obtain substantially all of the remaining benefits from the asset (e.g. by using the asset to produce goods or provide services, to enhance the value of other assets, or being able to sell the asset or pledge it as security for a loan), and

- Prevent others from directing the use of, and obtaining the benefits from, the asset.

A performance obligation may be satisfied:

- At a point in time, or

- Over time.

Over time

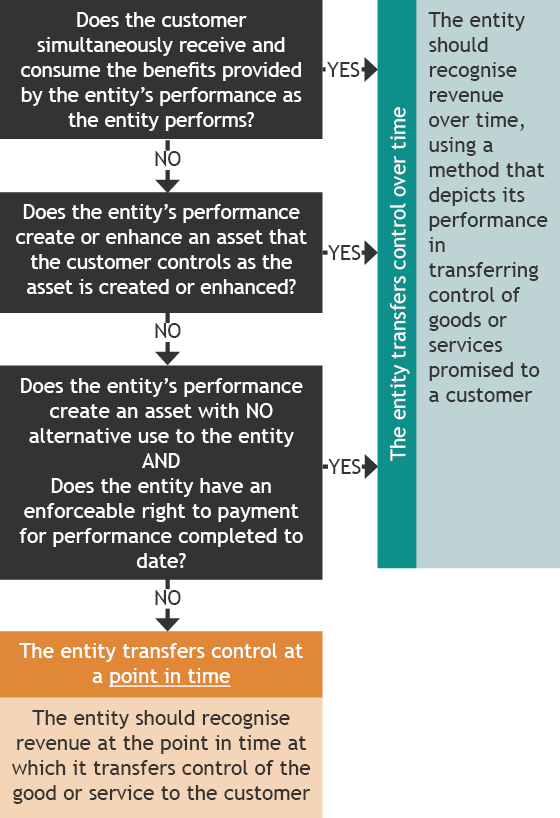

IFRS 15, paragraph 35 contains the requirements for recognising revenue over time. An entity transfers control of a good or service over time and, therefore, satisfies a performance obligation and recognises revenue over time, only if at least one of the following criteria is met:

- The customer simultaneously receives and consumes the benefits provided by the entity’s performance as the entity performs (this would occur, for example, in relation to the provision of nightly office cleaning services)

- The entity’s performance creates or enhances an asset (for example, work-in-progress) that the customer controls as the asset is created or enhanced, or

- The entity’s performance does not create an asset with an alternative use to the entity and the entity has an enforceable right to payment for performance completed to date.

| Customer simultaneously receives and consumes benefits | OR | Customer controls asset as it is created or enhanced | OR | Asset created has no ‘alternate use’ to entity AND entity has enforceable right to payment |

With respect to the third criterion above, an asset created does not have an alternative use to an entity if the entity is:

- Contractually restricted from directing the asset for another use during its creation or enhancement, or

- Practically limited from readily directing the completed asset for another use.

An ‘enforceable right to payment for performance completed to date’ requires the entity to be entitled to an amount that at least compensates the entity for performance completed to date if the contract is terminated by the customer or another party for reasons other than the entity’s failure to perform as promised. Such amount would approximate the selling price of the goods or services transferred to date (for example, recovery of the costs incurred by an entity in satisfying the performance obligation plus a reasonable profit margin), rather than compensation for only the entity’s potential loss of profit if the contract were to be terminated.

Point in time

If a performance obligation is not satisfied over time, an entity satisfies the performance obligation at a point in time.

To determine the point in time at which a customer obtains control of a promised asset and the entity satisfies a performance obligation, the entity must consider the indicators of the transfer of control, which include, but are not limited to:

- The entity has a present right to payment for the asset

- The customer has legal title to the asset

- The entity has transferred physical possession of the asset to the customer

- The customer has the significant risks and rewards of ownership of the asset

- The customer has accepted the asset.

The requirements for the recognition of revenue are best illustrated in the decision tree below:

Methods for recognising revenue over time

Where a performance obligation is satisfied over time, a method for measuring progress towards satisfaction of the performance obligation must be used. Appropriate methods of measuring progress include:

- Output methods – these recognise revenue on the basis of direct measurements of the value to the customer of the goods or services transferred to date relative to the remaining goods or services promised under the contract

- Input methods – these recognise revenue on the basis of the entity’s efforts or inputs to the satisfaction of a performance obligation (for example, resources consumed, labour hours expended, costs incurred, time elapsed or machine hours used) relative to the total expected inputs to the satisfaction of that performance obligation.

Example of output methods include surveys or appraisals of results achieved, milestones reached, time elapsed and units produced/delivered. The output method selected should faithfully depict the entity’s performance towards complete satisfaction of the performance condition.

In future editions of Accounting News we will look at some examples of the timing of revenue recognition.

Concluding thoughts

Under IAS 18 Revenue, revenue recognition was comparatively straightforward. When goods were being sold, revenue was recognised when the risks and rewards of those goods passed to the purchaser (which was frequently when legal tile passed) and when services were being sold, revenue was recognised on a percentage of completion basis.

Under IFRS 15, revenue can only be recognised over time if the strict criteria are met. A determination of whether those criteria have been met will often involve an in-depth examination of the terms of contracts that have been entered into with customers. As we have seen with all of the five steps in the IFRS 15 revenue recognition model, this will require finance teams to work with sales (and in some instances legal) teams to ensure that they have a sufficiently in-depth understanding of contractual terms to correctly identify when revenue should be recognised.